Is the investment world ready for an Abraham Accords stock index?

Steven Schoenfeld, CEO of MarketVector Indexes, says investors are looking for market-oriented vehicles to benefit from Middle East normalization

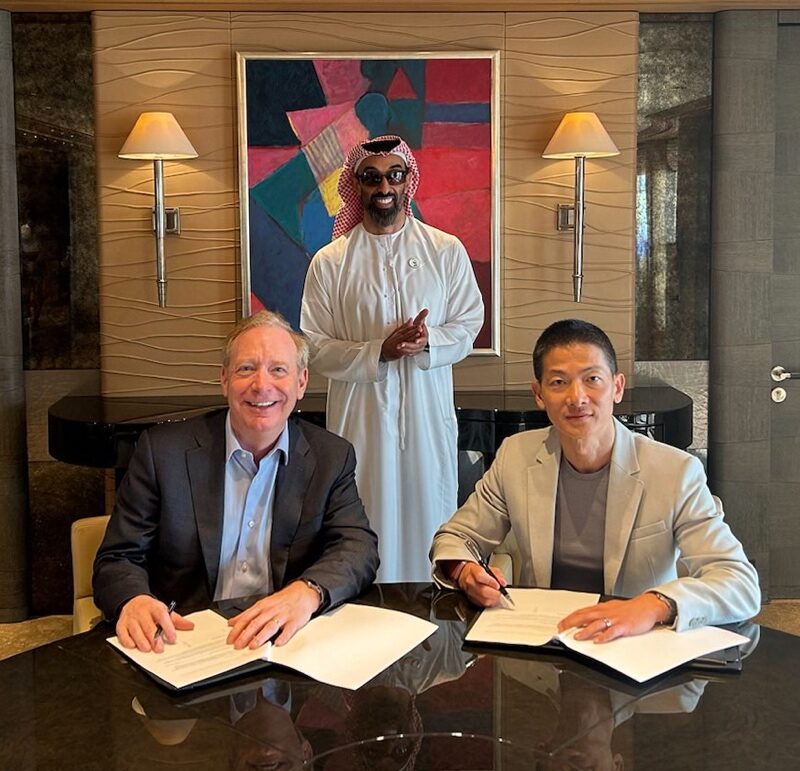

More than two years after the White House signing of the Abraham Accords in September 2020, stock index maker Steven Schoenfeld thinks it’s time to give retail and institutional investors an opportunity to profit from the broad business potential unlocked by the agreements.

“When you look at the combined equities markets of the Accords countries or even those countries that are part of [last year’s] Negev Summit, we could create a representative index of maybe 250 different stocks of companies that are benefiting directly or indirectly from the diplomatic outcomes,” Schoenfeld told The Circuit.

Schoenfeld is the CEO of MarketVector Indexes GmbH, which is based in New York and Frankfurt, Germany. He joined the firm in 2020 after it acquired his own company, BlueStar Indexes, which had created a roster of investment gauges built on tech and emerging markets stocks, along with indexes of Israeli stocks and bonds.

The 60-year-old New Yorker has been thinking for several years about ways to create a broader gauge that builds on a theme across the Middle East. The Abraham Accords, in which the United Arab Emirates, Bahrain, Morocco and Sudan agreed to normalize relations with Israel, made his hunches more realistic, as did the Negev Summit, in which Egypt also participated.

“Beginning in 2013 or 2014, years before the Abraham Accords, we prototyped what we call the “Mideast Peace and Development Index” that would include those countries that had diplomatic or economic relations with Israel,” Schoenfeld said in an interview. “The idea was not for the index to be some sort of political statement, but more a reflection of the impact, or benefit to companies of trade between the countries, including a small number of Palestinian and Jordanian companies.”

Schoenfeld, who earlier in his career was a Fulbright scholar researching the Asian derivatives markets, acknowledged that the idea of an Abraham Accords index was more aspirational, but pointed to a present-day regional opportunity, namely investing in gas and oil developments off the coasts of Israel, Egypt and Lebanon.

“We’ve already prototyped an index that potentially could represent Eastern Mediterranean energy development,” he said. “Imagine an index with the companies — that is, the stocks — involved in the offshore development, which would be players big and small, the likes of Chevron, Total, Delek and Energean.”

Among other prominent companies in the region, Schoenfeld said, “all of the airlines – El Al, Emirates, Etihad – have been big beneficiaries of the Accords, and would be obvious constituents in an index.”

Schoenfeld and his MarketVector colleagues currently create and license indexes that track countries from Australia to Vietnam. Along with his gauges that track the United Arab Emirates, Qatar, Israel and Turkey, these hypothetical baskets of stocks are used by fund issuers to create exchange-traded funds, or ETFs, that investors can use to “buy” a country’s performance.

A market index is a hypothetical portfolio of investment holdings that represents a segment of the financial market. The calculation of the index value comes from the prices of the underlying holdings. Among the most popular indices used to track the performance of the U.S. stock market are the Dow Jones Industrial Average, the S&P 500 Index and the Nasdaq Composite Index.

In the case of Israel, Summit, N.J.-based fund issuer ETFMG uses MarketVector’s BlueStar Israel Global Technology Index as the underlying gauge for its $118 million BlueStar Israel Technology ETF. ARK Invest, the St. Petersburg, Fla.-based asset management company led by chief investment officer Cathie Wood, uses an index created by gauge maker Solactive for its 76-stock ARK Israel Innovative Technology ETF.

Together with two others, BlackRock’s iShares MSCI Israel ETF and VanEck Israel ETF, the Israel-focused exchange-traded funds hold a combined $440 million in assets under management. The four ETFs are up 5.3% on average for the year-to-date. The Tel Aviv Stock Exchange benchmark TA-35, a proxy to the Israeli economy similar to the S&P 500, has eked out a 0.8% gain.

To be sure, the total invested in the four Israel-focused funds represents a tiny portion of the broader $5.75 trillion investment fund universe.

ETFs have become a top investment choice among both institutional and retail investors in the 30 years since their introduction. In 2022, 146 fund issuers attracted $604 billion in new investor money, at 12.3% annual organic growth, their second-biggest year of inflows despite sharp market declines, data provider FactSet reported earlier this month.

Until a cross-border index and ETF or other investment vehicle exists, Schoenfeld thinks regional interests could be served for an Israel-focused fund to be listed on the Dubai Financial Market, or for a UAE-oriented fund trading on the Tel Aviv Stock Exchange.

He admits that the phone isn’t ringing off the hook yet with Israeli investors looking for a way to play the new level of regional cooperation. Still, Schoenfeld said, “it’s only a matter of time.”

Robert Lakin is editor of the TLV Strategist newsletter and former markets editor for Bloomberg News in Tel Aviv.