The Weekly Circuit

👋 Good Monday morning in the Middle East!

Long one of the world’s top customers for Middle East oil and gas, China is making large investments in the region’s energy industry at the same time that it’s flexing diplomatic muscle in the Gulf and looking to sideline the U.S. This month’s acquisition by state-owned Sinopec of a 1.25% share in the first phase of QatarEnergy’s $30 billion liquefied natural-gas project is a demonstration of China’s intent to become a bigger power broker in the Middle East energy market, the Wall Street Journal reports. Qatar also signed a contract to supply China with an annual 4 million tons of LNG for the next 27 years.

The gas deals come a month after China brokered a rapprochement between Saudi Arabia and Iran, outflanking the Biden administration, which has irritated the kingdom with its criticism over human rights and floundered in trying to negotiate a new Iranian nuclear deal. Rising tensions between the U.S. and China have pushed energy suppliers in the region to broaden their customer base out of concern for being dependent on their traditional patrons in the West, according to the Journal.

Chinese industries are engaging with the Gulf in other ways, including finance. Hefei, China-based Hasten Biopharmaceutic raised $315 million in a funding round co-led by Mubadala, the Abu Dhabi sovereign wealth fund, and Singapore’s CBC Group, Asia’s largest health-care investment firm. Mubadala, meanwhile, is expanding activities in Latin America, announcing that its Acelen unit will invest $2.5 billion over the next 10 years to produce renewable diesel fuel and aviation kerosene in the Brazilian state of Bahia.

Welcome to The Weekly Circuit, where we cover the Middle East through a business and cultural lens. Read on for the stories, deals and players at the top of the news. Please send comments and story tips to [email protected].

Spread the word! Invite your friends to sign up.👇

FOUR-WAY TRADE

Business councils agree to promote pact linking UAE, Israel, India and U.S.

A joint campaign by the United Arab Emirates, Israel, India and the U.S. to stimulate trade is picking up momentum. Under the banner of the so-called I2U2 Initiative, business leaders from the four countries signed a memorandum of understanding last week pledging their cooperation in the project’s six target areas: water, energy, transportation, health, food security and space, The Circuit’s Jonathan Ferziger reports.

Regional pillar: The heads of the U.A.E.-India Business Council, the U.A.E.-Israel Business Council and the U.S.-U.A.E. Business Council approved the document calling for private sector involvement in the partnership, following up on the I2U2 Business Forum that was held in the UAE capital of Abu Dhabi in February. Dorian Barak, co-chairman of the UAE-Israel group, told The Circuit that the agreement will help Israelis who have found India a complex place to do business. “Some have succeeded magnificently, while many others are now finding that Dubai offers a simpler and more familiar way of engaging with Indian consumers and suppliers.”

Biden boost: The I2U2 group was established in 2021 as an outgrowth of the Abraham Accords. It was given a top-level boost during President Joe Biden’s trip to the Middle East last July, when he visited Jerusalem and met with Yair Lapid, who was Israel’s prime minister at the time. Joining them in a video conference to launch the I2U2 initiative were Indian Prime Minister Narendra Modi and the UAE’s leader, Sheikh Mohammed bin Zayed Al Nahyan, now president.

Food security: In a Washington event to mark the agreement’s signing, the U.S. under secretary of state for economic, growth, energy and the environment, Jose Fernandez, praised the I2U2 as a good example of helping allies increase regional trade. Also present at the meeting in Washington’s St. Regis Hotel were Yousef Al Otaiba, UAE ambassador to the U.S.; Sripriya Ranganathan, India’s deputy chief of mission to the U.S.; and Eliav Benjamin, Israel’s deputy chief of mission to the U.S.

Stimulating ventures: Among the activities planned by the business councils is a series of events held in the four member countries aimed at stimulating commercial ventures. The councils also intend to commission a series of research papers exploring business opportunities in the six target areas. The first project announced after the video conference in July was a $2 billion investment by the UAE in developing a series of food parks across India that would use Israeli and U.S. technologies.

Click here to read the full story.

PRESSURE RISING

Israeli tech startups gird for long-term decline in venture capital funding

Israeli technology companies, the country’s economic engine and branding platform for three decades, are scraping for cash and trying to protect what they’ve raised by moving funds abroad. While the government has temporarily paused its proposed judicial overhaul that led to a downgrade by Moody’s Investors Service of Israel’s economic outlook, startup founders are making contingency plans that include transferring key employee teams to other countries and shifting money from domestic accounts, The Circuit’s Jonathan Ferziger reports.

Different ball game: The concerns were reflected in a survey published this month by a nonprofit organization that has spent years cheerleading for Israel’s tech industry and promoting its potential value to new markets such as the United Arab Emirates, Bahrain and Morocco. Banking data from the first quarter of 2023 showed a 71% decline in startup investment from the same period last year. “To move your capital outside Israel takes a phone call,” Avi Hasson, CEO of Start-Up Nation Central, which commissioned the survey, told The Circuit. “But if you’re moving projects or people outside of Israel, that’s a whole different ball game, both in the investment and effort needed to do it as well as the investment and effort needed to bring it back.”

Netanyahu vs. Moody’s: In its April 15 statement, Moody’s said downgrading the credit outlook “reflects a deterioration of Israel’s governance” under the coalition led by Prime Minister Benjamin Netanyahu that won election in November. Netanyahu, on the other hand, has sought to provide assurances that his government won’t harm the investment climate, pointing to his record as an economic reformer whose policies played a large role in building Israel’s reputation as a technology powerhouse. Disparaging protests against his government, Netanyahu told CNBC last week that “the fundamentals of the Israeli economy are very powerful.”

Cash transfers: Based on 1,142 responses from companies, investment firms and multinational corporations, the survey, published on April 13, demonstrated how operating abroad is increasingly seen as an option. Among the findings, 46% of the companies are planning to move cash reserves outside of Israel, and 58% of those plan to transfer more than 50% of their money. About a quarter are considering plans to relocate employees out of Israel, and 42% are looking into changing their registration to another country.

Recovery capabilities: Regarding current sentiment, 84% of investors expect the changes to have a negative effect on the ability of companies to raise capital from abroad while 77% of companies believe it will be difficult to raise capital from foreign investors. Hasson said he hopes negotiations on the judicial package that are underway with opposition leaders will lead to a compromise that doesn’t deter investment. “People are still developing products and selling them and so on,” he said. “I think the recovery capabilities of the ecosystem are really, really strong.”

Circuit Chatter

Sudan Struggle: The UAE, Russia and Egypt are focused on the conflict in Sudan in part because of their interests in its natural resources and shipping access, the Wall Street Journal reports.

Crypto Centers: San Francisco-based crypto exchange Coinbase, which received a license to operate in Bermuda, said it’s also looking to operate in the UAE.

Dialysis Hub: Mubadala and G42 in Abu Dhabi acquired European dialysis chain Diaverum for an undisclosed price, creating the Mideast’s largest health-care company.

Digital Shekel: Israel’s central bank is studying the possibility of establishing a digital currency, noting the declining use of cash and similar trends in the U.S. and Europe.

Heavy Traffic: Auto Tager, an Egyptian startup that streamlines buying and selling cars, was acquired by Nigeria’s Autochek, which is expanding its North Africa business.

Blue Skies: El Al controlling shareholder Kenny Rozenberg increased his stake in Israel’s national airline to 49.95%, buying shares from the state and the Borowitz family.

Rich Tastes: Morocco’s Marrakech is among the cities most popular with the super wealthy, according to a list by Henley & Partners that was led by New York and Tokyo.

Burger Frontier: Shake Shack, the popular U.S. hamburger chain, signed a deal with Israel’s Harel Wizel and Yarzin Sella Group to open its first restaurant in Tel Aviv.

Closing Circuit

Telecom Towers: Saudi Arabia’s Tawal will pay $1.3 billion to acquire United Group’s telecom tower assets, which include 4,800 sites across Bulgaria, Croatia and Slovenia.

Digital Shield: Israeli cybersecurity company Coro raised $75 million in a financing round that included Energy Impact Partners, Balderton Capital and JVP.

Farm Funding: Israel’s CropX agritech company raised $30 million in a financing round led by Belgium-based Aliaxis SA, with participation of Edaphon, OurCrowd and Victrix.

Amex Alumnae: Vesey Ventures, based in New York and Tel Aviv, raised $78 million for its first fund, founded by three women who were managing directors of Amex Ventures.

Red Rock: Israel’s Azrieli Group bought the Red Rock hotel in Eilat for $35.5 million. It plans to demolish the hotel and invest as much as $163 million in building a new hotel.

Health Watch: Israel’s Neteera Technologies, which develops patient monitoring systems, raised $13 million in a financing round led by Aescuvest.

On the Circuit

Ray Dalio, founder of Bridgewater Associates, the world’s largest hedge fund, plans to open a family investment office at the Abu Dhabi Global Market.

Selcuk Yorgancioglu, a former top executive of defunct Dubai-based Abraaj, was barred from World Bank projects for two years as part of a settlement on fraud charges.

Iddo Gino, who founded Israeli programming startup Rapid at age 17 and turned it into a billion-dollar company, will step down as CEO and be replaced by CFO Marc Friend.

Ahead on the Circuit

April 26-27, Dubai, UAE: FiNEXT Awards and Conference 2023. A platform for global investors, financial institutions and fintech companies to interact. Le Meridien Dubai Hotel and Conference Centre.

May 2-3, Tel Aviv, Israel: Agritech Israel. Introducing innovative farming technologies for growing food and meeting the challenges of climate change, water shortages and desertification. Expo TLV.

May 3, Tel Aviv, Israel: GoForIsrael Investment Conference. Connecting global investors and technology companies. Co-hosted by Cukierman & Co and Catalyst Investment. Tel Aviv Hilton.

May 10-11, Abu Dhabi, UAE: UAE Climate Tech. Government-sponsored conference bringing together business leaders and policymakers in preparation for U.N.’s COP28 climate summit in November. Abu Dhabi Energy Centre.

May 11, Dubai, UAE: Annual Private Wealth Middle East Forum. Conference connecting family offices, high-net-worth wealth managers and investors. Shangri-La Hotel.

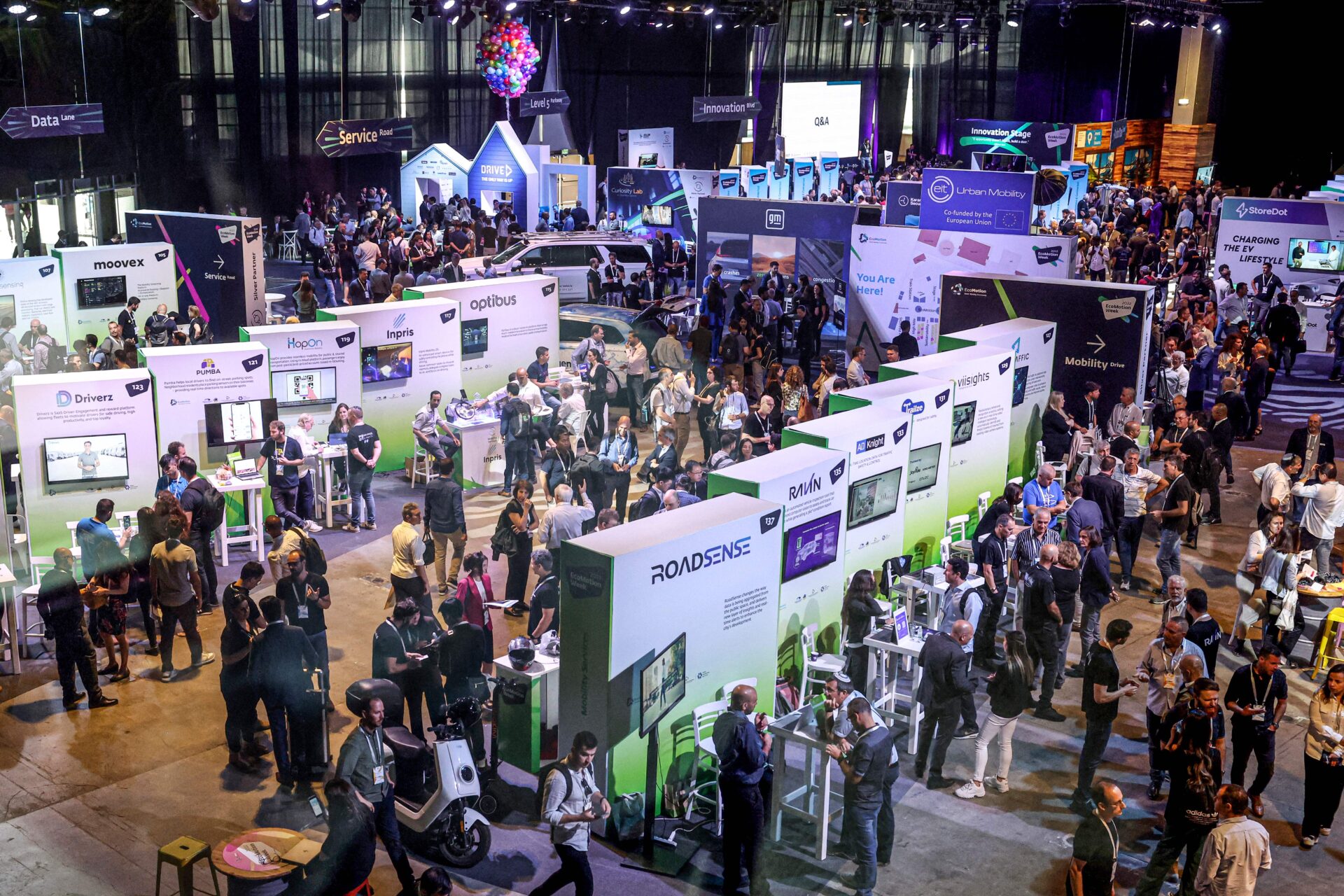

May 15-16, Abu Dhabi, UAE: Mobility Live Middle East 2023. Conference brings together investors, corporate executives, policymakers to discuss the future of transportation. Abu Dhabi National Exhibition Center.

May 23-25, Doha, Qatar: Qatar Economic Forum. Qatari financial leaders, international investors and corporate executives meet to discuss global financial challenges in conference co-sponsored with Bloomberg.

May 29-31, Tokyo: Israel-Japan Innovation and Technology Conference. Calcalist newspaper and Israel Discount Bank holds three-day conference pairing Israeli and Japanese investors and business executives. Toranomon Hills Forum.

Culture Circuit

Trafficked Treasures: Louvre Director Laurence des Cars says museums should as a general rule be willing to return works of art and antiquities that are proven to have been illegally trafficked. Speaking in an interview with the Financial Times, des Cars declined to comment directly on the French investigation of her predecessor in a case of suspected antiquities trafficking for the Louvre Abu Dhabi.

Newcastle Aims High: Backed by Saudi Arabia’s sovereign wealth fund, Newcastle United has built its way to becoming a prime contender in U.K. soccer, the Wall Street Journal reports. In October 2021, the club was mired in 19th place and at peril of being relegated from the English Premier League. Since its $380 million acquisition by a group including the Saudi Public Investment Fund, Newcastle has spent $110 million on recruiting top-class talent. With yesterday’s 5-1 victory over Tottenham Hotspur, Newcastle vaulted to third place and a reasonable bet for the Premier League title.

Remembering the Songs: Yehonatan Geffen, one of Israel’s best-known singer/songwriters, died at 76 from cancer. Geffen, a prominent left-wing activist and father of singer Aviv Geffen, wrote some of the country’s most familiar tunes, including “Yihyeh Tov” (It Will Be Good), “Hayaldah Hachi Yafah BaGan” (Prettiest Girl in the Kindergarten) and “Atem Zochrim at Hashirim” (You Remember the Songs). In a message after Geffen’s death, Israeli President Isaac Herzog said, “It is hard to imagine the existence of Israeli art, our hymns, the world’s of literature and theater, without his unique and unforgettable contribution.”

Immersive Theme Park: SeaWorld Abu Dhabi is slated to open next month with what is billed as the world’s largest multi-species aquarium, which contains over 6 million gallons of water and 68,000 marine animals. The theme park, operated by Orlando, Fla.-based SeaWorld Parks & Entertainment and Miral, a UAE developer of immersive leisure destinations, will welcome its first visitors on May 23 to the 45-acre site on Yas Island.