The Weekly Circuit

👋 Good Monday morning in the Middle East!

The Paris Air Show opens today, bringing airline executives, cabinet ministers and defense contractors to the world’s biggest aviation event. Saudi Arabia will use the seven-day exhibition to introduce its new carrier, Riyadh Air, which is negotiating with Boeing and Airbus over a fleet of narrow-body jets. The company plans to start flying its purple and blue aircraft in 2025 and announced a provisional order in March for up to 72 Boeing 787 Dreamliners.

Israel’s Rafael Advanced Defense Systems will for the first time show off its new SkySonic system, designed to intercept missiles that fly at several times the speed of sound. Interest is building at the French exhibition amid assertions by Russia that it has used hypersonic missiles against Ukraine. Iran claimed this month that it created a hypersonic missile called “Fattah” – Conqueror in Farsi – that can travel at 15 times the speed of sound. Rafael is testing SkySonic but hasn’t said when it will be ready for operation.

The German Bundestag’s vote last week to approve the $4.3 billion purchase of Israel Aerospace Industries’ Arrow-3 missile-defense system is also generating buzz in Paris. “Basically, we have a solution for air defense on all layers, from very short-range like 10, 20 or 25 kilometers, to ballistic missiles,” Golan Haver, the state-owned company’s senior vice president for Europe, told The Circuit.

Among those expected at the show in Paris’ Le Bourget Airport will be Israeli Defense Minister Yoav Gallant and IAI Chairman Amir Peretz, representatives said. The Israeli Defense Ministry announced a record $12.6 billion in defense exports last year, saying that almost 25% of that amount came from partners to the Abraham Accords. It did not detail what portion of the exports came from which of the countries that include the United Arab Emirates, Bahrain, Morocco and Sudan.

Two Senate Democrats announced plans last week to investigate the proposed partnership between the PGA Tour and the Saudi-backed LIV Golf circuit. Washington Post columnist Fareed Zakaria wrote that the golf deal illustrates the growing economic and political clout of the Gulf states in world affairs amid high oil prices. “This surge of wealth has reshaped the Middle East,” Zakaria wrote. “The Gulf is where the action is.”

The Biden administration is making a renewed pitch to bring Saudi Arabia and Israel together for a normalization agreement, the New York Times reported. Saudi Arabia’s minister of investment, Khalid Al-Falih, told CNBC that the world has become multipolar and his country’s ties with China will “only come closer as their common interests grow.”

Welcome to The Weekly Circuit, where we cover the Middle East through a business and cultural lens. Read on for the stories, deals and players at the top of the news. Please send comments and story tips to [email protected].

Spread the word! Invite your friends to sign up.👇

MEDICAL MILESTONE

UAE’s PureHealth, Israel’s Sheba Medical Center sign cooperation agreement

PureHealth, the largest health care company in the United Arab Emirates, and Israel’s Sheba Medical Center signed an agreement last week to conduct joint research, collaborate on staff training and combine efforts to promote medical tourism. The two institutions approved a memorandum of understanding outlining their intention to work together across a range of medical fields, The Circuit’s Jonathan Ferziger reports.

Gaining momentum: Israel’s ambassador to the UAE, Amir Hayek, told The Circuit that the preliminary agreement demonstrates a growing momentum for the Abraham Accords, which normalized relations between the two countries in 2020. “We are talking to each other about everything,” Hayek said in an interview from Abu Dhabi. “We are open about everything and we are past the point of no return.”

Emirati visit: The agreement follows a visit to Sheba, near Tel Aviv, and other Israeli health facilities last week by top executives and doctors from the Emirati organization, Hayek said. PureHealth is a $5 billion subsidiary of Abu Dhabi’s ADQ sovereign wealth fund that was formed last year to consolidate the UAE’s major health institutions, including Abu Dhabi Health Services Co., The National Health Insurance Co., Tamouh Healthcare and the Abu Dhabi Stem Cell Center. PureHealth operates 25 hospitals and 100 clinics across the Gulf state.

Robust partnership: “This collaboration marks a major milestone in our efforts to drive healthcare innovation and improve patient outcomes,” Rashid Al Qubaisi, PureHealth’s group chief corporate officer, said in a statement. “By combining our expertise and resources, we aim to foster breakthrough research, advance medical education, and establish a robust framework for clinical services coordination.”

Expanding trade: Since the signing of the U.S.-backed Accords at the White House in September 2020, trade between the UAE and Israel has exceeded $3.8 billion and the two countries expect commercial activity to reach $10 billion by the end of 2026. ADQ reached an agreement in December to buy control of Phoenix Holdings, Israel’s biggest insurer, for about $675 million. The deal is under regulatory review in Israel.

Click here for the full story.

TALENT GAP

UAE’s G42 teams up with Viola Ventures to address worldwide tech employee shortage

A government-owned technology company in the United Arab Emirates and Israel’s largest private investor in tech firms launched a joint venture aimed at providing computer engineers and other skilled employees to businesses around the world. The new company, Global Valley, will be based in Abu Dhabi, the UAE’s capital, and address an international shortage of programming talent, The Circuit reports.

Artificial Intelligence: Global Valley brings together Abu Dhabi’s G42, which has interests ranging from biotechnology to artificial intelligence, the Abu Dhabi Investment Office and Israel’s Viola Ventures, which has $5 billion in assets under management, the companies said in a statement on Thursday. G42 is controlled by Sheikh Tahnoon bin Zayed, the UAE’s national security adviser and younger brother of UAE President Mohamed bin Zayed, ruler of Abu Dhabi.

Dynamic hub: The new company will strengthen Abu Dhabi as a “dynamic hub for technological advancement and business prowess,” G42 Group Chief Executive Peng Xiao said. Avi Zeevi, a co-founder and general partner of Viola, said Global Valley “will provide tech companies, in Israel and globally, with the best-of-class tech talent to fuel their future growth and support their activities in the region.”

Global shortage: While the ongoing global economic slowdown has led to layoffs that increased the supply of tech workers, the industry expects the employee shortage to grow. A study by the consulting firm Korn Ferry predicts a global talent gap by 2030 of some 85 million employees in the telecommunications, media and technology sector.

Click here for the full story.

Circuit Chatter

New Frontiers: The $450 billion Qatar Investment Authority is considering investments in the U.S. and Asia, showing interest in technology and health care, Bloomberg reported. The sovereign wealth fund is also in talks with Egypt about investing in seven historic hotels located in Cairo, Aswan, Luxor and Alexandria, according to Reuters.

Gaming Hub: Saudi Arabia and the UAE are investing billions of dollars into gaming and esports companies, turning the Middle East into an industry hub, a BCG report says. Google, meanwhile, announced the first Google MENA Gaming Summit, which will be held in Riyadh by year’s end.

Silicon Valley Rivals: Israel, the UAE and Saudi Arabia are gaining on Silicon Valley in spawning new technology companies, a report by Startup Genome consultants said.

Oil Challenge: Iran is shipping the most crude oil in almost five years as it reengages with Saudi Arabia while competing in the global energy market, Bloomberg reported.

Easy Visa: Morocco and Israel agreed to ease visa requirements for travelers from both countries and enable more Moroccans to work in Israel.

Gaza Gas: Israel said it will work with Egypt on long-stalled plans to help develop a natural gas field owned by the Palestinians off the coast of the Gaza Strip.

IPO Pick: Dubai-based Amanat Holdings selected EFG Hermes and First Abu Dhabi Bank to manage the planned IPO of its health care unit, Bloomberg reported.

Closing Circuit

Chip Maker: Intel Corp. reached an agreement in principle with the Israeli government to invest $25 billion in expanding its semiconductor chip production plant in the southern town of Kiryat Gat. Israel will provide a $3.1 billion grant for the project.

Startup City: Dubai’s startup technology companies raised more than $2 billion last year, double that in 2021, capturing some 30% of funding rounds in the MENA region.

Gulf Drugmaker: Saudi Arabia’s Public Investment Fund opened a company named Lifera to promote pharmaceutical manufacturing in the country.

Bicycle Fund: Abu Dhabi’s Mubadala sovereign wealth fund will invest $200 million in Bicycle Capital, a private equity firm run by Marcelo Claure, former COO of SoftBank.

IPO Channel: Saudi Arabia’s Jada Fund of Funds, a subsidiary of its sovereign wealth fund, plans to invest in Investcorp’s $500 million Saudi pre-IPO growth fund.

Luxury Homes: Emaar Properties unveiled plans for a $20 billion waterfront project in Dubai called “The Oasis,” with 7,000 residential units that include mansions and villas.

Japanese Property: Abu Dhabi-based Mubadala will invest in Japanese real estate through a $572 million joint venture with Proprium Capital Partners and Manulife.

New Incentives: Saudi Arabia’s giant Neom city-building project signed agreements with several government ministries to provide more incentives for attracting investment.

Egyptian Assets: Egyptian Chemical Industries, the state-owned fertilizer producer known as Kima, may sell a stake to a unit of Abu Dhabi’s ADQ sovereign wealth fund.

Big Events: The Abu Dhabi Investment Authority holds a large stake in a group managed by Blackstone that acquired Virginia-based Cvent for $4.6 billion.

On the Circuit

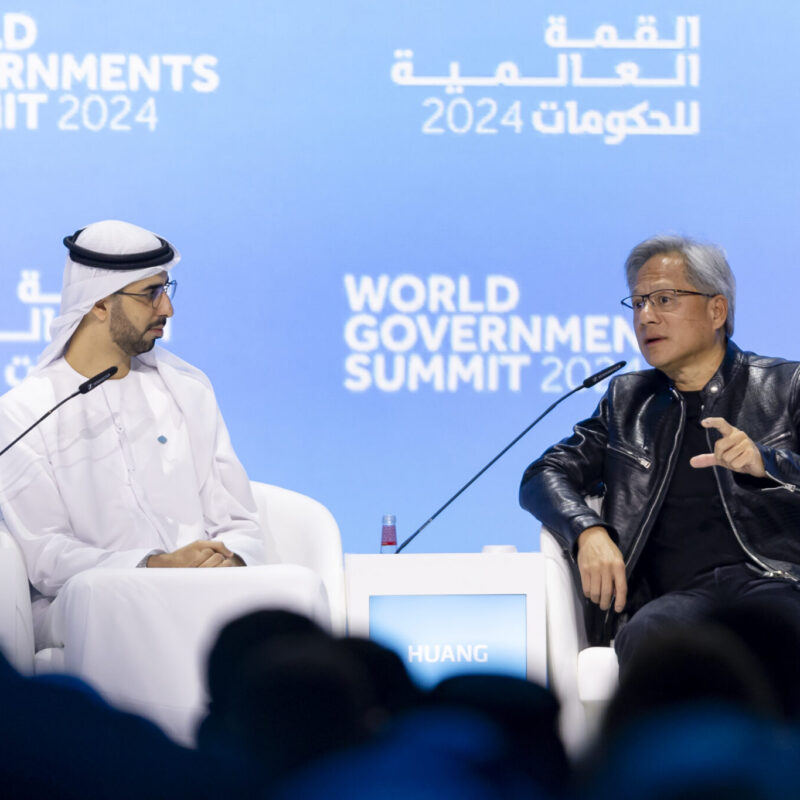

Elon Musk, owner of Twitter and CEO of Tesla, chatted on tech regulatory matters with the UAE’s minister of state for artificial intelligence, digital economy and remote work application, Omar Al Olama, who termed the discussion “refreshing.”

Yosef Zinger was appointed chairperson of the Israel Securities Authority by Finance Minister Bezalel Smotrich, replacing Ana Guetta.

Oren Zeev, founding partner of Israel’s Zeev Ventures, talks on the “Venture Unlocked” podcast about why he believes VCs are still a good long-term investment.

Ahead on the Circuit

June 19, Tel Aviv, Israel: FinTech-Aviv Summer Summit 2023. Brings together startups, investors and corporate executives. Mindspace, 5th floor.

June 20-21, Tel Aviv, Israel: Fintech Junction. Conference draws investors, bankers, regulators and fintech executives. Hilton Tel Aviv.

June 20-22, Riyadh, Saudi Arabia: The Saudi Food Show. Chefs, restaurateurs, food company executives and government officials gather for trade show. Riyadh .International Convention and Exhibition Center.

June 21-25, Dubai, UAE: Dubai Esports and Games Festival. Gamers, designers, investors come together for four-day event that includes competitions and conferences. Dubai Exhibition Centre.

June 23, Dubai, UAE. Dubai One Health Conference. Doctors, researchers and government officials discuss public health, as well as the health of animals, plants and the environment. Movenpick Grand Al Bustan Hotel.

July 25, Los Angeles. CNBC x Boardroom: Game Plan. Athletes, owners, investors and innovators discuss what drives the modern-day sports fan to emerging opportunities in teams and leagues. Register to receive location.

Culture Circuit

Hot Wheels: Gearing up for Formula 1 season, the Qatar Grand Prix is offering a $7,350 “Ultimate Fan Experience” ticket for 33 times the price of standard admission to the Oct. 6-8 event at the Lusail International Circuit. The premium ticket includes access to a prime viewing area above the pit lane that looks over the finish line, parking, a guided F1 track tour, a lunch with F1 drivers and former stars, admission to the exclusive Paddock Club and a pit lane walkabout. A standard three-day ticket costs $220.

Open Book: The National Library of Israel is kicking off a series of “Epilogue” events this week, celebrating 63 years in which the nation’s literary archive has been housed on the Jerusalem campus of the Hebrew University. The first is a 13-hour festival featuring performances by Israeli writers, musicians, actors and stand-up comedians that takes place on Wednesday. The National Library’s $200 million new home, featuring an iconic sloped roof and located next to the Knesset, Israel’s parliament, opens later this year.

Baalbeck Beat: Lebanon’s 60-year-old Baalbeck festival opens July 1 and will bring some of the best Middle East music acts to the Roman Acropolis site. Performances will include theater, opera, jazz, Arab pop and dance. Among the most popular acts appearing this year are the Al-Kindi Ensemble with Sheikh Hamed Daoud and the Damascus Whirling Dervishes. Lebanese pop star Melhem Zein will be a hometown favorite at Baalbeck.