Microsoft to invest $1.5 billion in Abu Dhabi’s G42

The deal gives Microsoft a minority stake in the artificial intelligence firm chaired by Sheikh Tahnoon bin Zayed

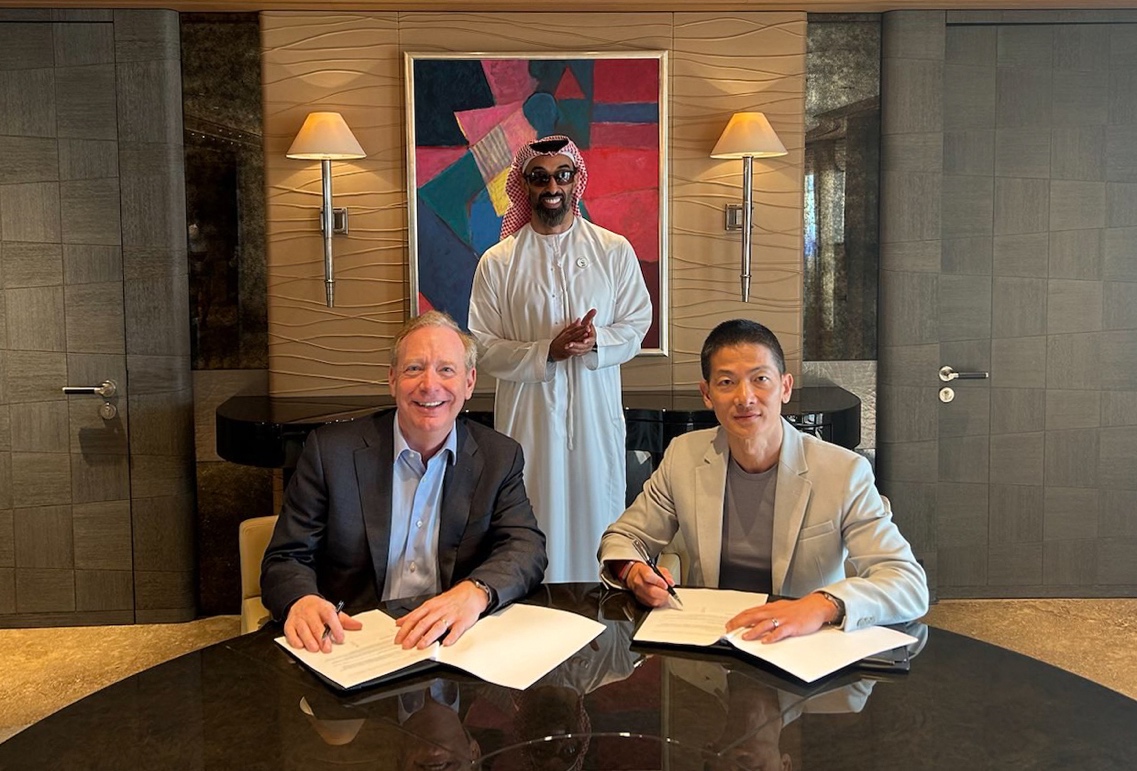

Sheikh Tahnoon bin Zayed with Brad Smith, Vice Chair and President of Microsoft, and Peng Xiao, Group Chief Executive Officer of G42, at the signing of a deal for Microsoft to invest $1.5 billion in Abu Dhabi’s G42 earlier this year.

Microsoft will invest $1.5 billion in Abu Dhabi artificial intelligence firm G42, providing one of the biggest inbound investments from an outside player yet and lending credibility to the UAE’s ambitions to become a world-leading technology hub.

The deal gives Microsoft a minority stake in G42 and offers Vice-Chair and President Brad Smith a seat on its board.

“Microsoft’s investment in G42 marks a pivotal moment in our company’s journey of growth and innovation, signifying a strategic alignment of vision and execution between the two organizations,” Sheikh Tahnoon bin Zayed, Chairman of G42, said in a statement.

Sheikh Tahnoon, who also serves as UAE National Security Advisor and Chairman of sovereign wealth funds ADQ and Abu Dhabi Investment Authority, was photographed at a signing between Smith and G42 CEO Peng Xiao.

The commercial partnership is “backed by assurances to both governments” for secure AI development, the companies said, a signal to critics that the U.S.-UAE technology partnership is strong and that G42 has severed ties to China.

U.S. Commerce Secretary Gina Raimondo, traveled twice to the UAE to talk about security arrangements for the Microsoft deal and other partnerships, The New York Times reports.

The firms also agreed to a further $1 billion development fund to support training an AI workforce and talent pool in the UAE and for the wider region.

“Our two companies will work together not only in the UAE, but to bring AI and digital infrastructure and services to underserved nations,” Smith said. “We will combine world-class technology with world-leading standards for safe, trusted and responsible AI, in close coordination with the governments of both the UAE and the United States.”

Last month, G42 alongside Abu Dhabi’s sovereign wealth fund Mubadala, launched an AI investment company called MGX with the ambition of building up $100 billion in assets under management within a few years.

The fund is reportedly now in early talks with Sam Altman, whose OpenAI is backed by Microsoft, to invest in his multi-trillion-dollar chip venture.