The Weekly Circuit

👋 Good Monday morning in the Middle East!

Officials from Saudi Arabia, India and the U.S. will start following up over the next two months on an agreement reached by their leaders at this past weekend’s G20 Summit to build a rail and shipping corridor linking India with the Middle East and Europe. The deal was capped on Saturday with a three-way handclasp by U.S. President Joe Biden, Saudi Crown Prince Mohammed bin Salman and Indian Prime Minister Narendra Modi in New Delhi.

Ultimately, the project is intended to stretch across the Arabian Peninsula and connect through Jordan to Israel’s rail system, reaching the Mediterranean port city of Haifa, where ships can carry goods to Europe. Completing the plan, however, may hinge on increased normalization between Saudi Arabia and Israel, which has been the subject of ongoing talks led by the Biden administration. No timetable or cost estimate for the massive infrastructure project was announced at the G20 meeting.

The rail deal was unveiled days before this week’s third anniversaryof the Abraham Accords, which normalized Israel’s relations with the UAE and Bahrain at a White House signing ceremony on Sept. 15, 2020. During a symposium in Tel Aviv to mark the anniversary, Bahraini Ambassador Khaled Al-Jalahma said cooperation is flourishing with Israel despite challenges he attributed in part to cultural differences and some reluctance by Bahrainis to travel there. “Just because it’s slow, doesn’t mean that it isn’t good,” Al-Jalahma said during the event last week at the office of Start-Up Nation Central.

Offers to send rescue crews and medical aid are pouring into Morocco following a magnitude-6.8 earthquake that killed more than 2,100 people, the country’s deadliest quake since 1960. The epicenter of the temblor was located in the High Atlas Mountains about 45 miles southwest of Marrakesh. The city, which sustained damage from the quake, is scheduled to host the annual meetings of the International Monetary Fund and World Bank in October.

Having spent $875 million in the past three months to recruit top foreign players, Saudi Arabia has become world soccer’s second-biggest transfer market after the U.K. Brazil’s Neymar and former Liverpool FC captain Jordan Henderson are among the international stars who signed big-money contracts in the kingdom over the summer. The heavy spending reflects Saudi Arabia’s determination to become a world sports power and follows the Saudi-backed LIV Golf tournament’s proposal in June to merge with the PGA.

Welcome to The Weekly Circuit. Read on for the stories, deals and players at the top of the news across the MENA business landscape. Please send comments and story tips to [email protected].

FISH TALE

UAE’s Ocean Harvest plans salmon farming in the desert

Five years after Pure Harvest pulled in its first hydroponically grown tomato crop, setting the Abu Dhabi-based company on a path to becoming one of the Gulf’s biggest agtech firms, co-founder Robert Kupstas is ready to grow something different: fish.

Next phase: The entrepreneur’s latest venture, Ocean Harvest, which he founded in 2021, has raised $2.1 million in seed funding, set up shop one floor away from Pure Harvest’s offices and hired an industry veteran in aquaculture, The Circuit‘s Kelsey Warner reports. Last month the company named a new CEO, venture capitalist Jawad Jamil, making a team of three that is ready for the next phase: a Series A fundraising round with a $180 million target of mixed equity and debt. The money will go to fund a 100,000-square-meter facility planned in the northern emirate of Ras Al Khaimah and later expansion into Saudi Arabia and markets in Asia.

Target investors: “We’re looking for strategic investors, sovereign wealth funds, impact investors [and] infrastructure investors because we need those kinds of shareholders,” Jamil told The Circuit. “They are the ones who are not just looking at pure financial returns… getting my 3x, 5x [returns] and getting out. They have the understanding, the patience that is required to understand the intricacies of building such complicated infrastructure. And there’s more at play.”

By the numbers: Indeed there is: The UAE imports 90% of its food and agriculture contributes less than 0.1% to GDP, according to a 2023 government report. Mariam Hareb Almheiri, minister of climate change and environment, has called aquaculture “a core component of the UAE’s national food security strategy.”

Not the first: Growing salmon in the desert is not all that outlandish — the UAE has been making forays into the booming fish farming industry in recent years. The first UAE-raised salmon hit grocery stores in 2019 from Dubai start-up Fish Farm, which last year signed a major distribution deal with ASMAK, a UAE seafood conglomerate with operations across the Middle East and North Africa region.

DEAL DRIVER

Kushner’s Affinity to buy stake in Israel’s Shlomo car firm

After two years of scouting, Jared Kushner’s Gulf-backed private equity fund, Affinity Partners, will make its first investment in Israel, buying a $150 million minority stake in the country’s largest car rental agency and affiliated businesses, The Circuit’s Jonathan Ferziger reports.

Key acquisition: Miami-based Affinity agreed last week to acquire 15% of the automotive and credit unit of Shlomo Group, which is the Israeli partner of Germany’s Sixt, the No. 5 international car rental company. The Israeli firm has a fleet of 78,000 vehicles, along with leasing, sales and car financing divisions. “We are bullish on the long-term growth prospects of Israel and the broader new Middle East,” Kushner, the son-in-law of former President Donald Trump, said in a statement.

Sovereign backing: The fund, which is backed by $2 billion from Saudi Arabia’s Public Investment Fund and hundreds of millions from sovereign wealth funds in the UAE and Qatar, did not seek permission from any of its partners to buy the stake in the Israeli company, a person familiar with the matter told The Circuit. The person asked not to be identified due to sensitivities.

The players: Saudi Arabia and Israel do not have diplomatic ties, although they are engaged in U.S.-brokered talks to normalize their relations, as the United Arab Emirates, Bahrain and Morocco did through the Abraham Accords in 2020. Qatar also doesn’t have official relations with Israel.

Moving forward: Under the agreement, a new $1 billion subsidiary will be created that will operate Shlomo Group’s rental, sales and credit business, the statement said. Affinity, which has an option to buy an additional 3%, will appoint a director and an observer to the division’s board of directors. It also plans to “promote joint company transactions in the Middle East and North America.”

Click here to read the full story.

Circuit Chatter

🎥 Hollywood Return: Former U.S. Treasury Secretary Steven Mnuchin’s Saudi-backed Liberty Capital Fund acquired 5.5% of entertainment company Lionsgate for $30.8 million.

🛢️ Net Zero: With less than 90 days to go to COP28, state oil company Adnoc announced it will triple its installed carbon capture capacity with a new project south of Abu Dhabi, due to be completed by 2026.

⚖️ Cease-Fire: Israeli Prime Minister Benjamin Netanyahu told Moody’s analysts he will try to reach consensus with opposition lawmakers to pass further judicial reforms, trying to persuade the agency not to cut the country’s credit rating. The Israeli shekel has weakened 12% since January to a three-year low, trading at 3.85 against the dollar.

💱 Currency Rates: Lebanon will replace its central bank’s Sayrafa currency exchange platform with a Bloomberg system because of concerns over transparency and sustainability.

🌍 Tapping the Diaspora: Morocco’s Mohammed VI Polytechnique University launched a program to connect African expats with their home countries to fuel technology innovation, entrepreneurship and startups.

🏢 Eastern Exchange: Abu Dhabi’s Mubadala sovereign wealth fund opened an office in Beijing with a headcount of 10 and a focus on direct and fund investments, Reuters reports.

🚢 Ghost Ship: Saudi Arabia entered into a three-party agreement to develop regulation and capabilities to make autonomous ships part of its maritime fleet.

🖥️ Flying High: The latest update to Abu Dhabi’s open-source AI large language model in Arabic, known as Falcon, outperforms Meta’s LLaMA 2 in various benchmarks, including reasoning, coding and knowledge tests.

🕵️ Spyware Patch: Apple issued a software update last Thursday to plug a security flaw that allowed the Pegasus spyware produced by Israel’s NSO Group to secretly breach iPhones.

🥤 Liquid Gold: Saudi Crown Prince Mohammed bin Salman established a new global organization to tackle water supply challenges to be based in Riyadh.

⚒️ Digging Deep: Saudi Arabia is looking to tap into vast zinc and copper reserves, worth an estimated $1.3 trillion, but so far has no international mining backers to support the ambition, Bloomberg reports.

🌙 Shariah Investment: Israel’s Aviv Fund Management opened two funds that are aimed at Arab investors and compliant with Shariah law.

Closing Circuit

☀️ Sunny Side: Dubai state utility company DEWA and Abu Dhabi renewable energy firm Masdar signed a deal to complete the sixth phase of what will be the world’s biggest solar park at an estimated cost of $1.4 billion.

📱 Riyadh Calling: STC, Saudi Arabia’s biggest telecom operator, bought up a 9.9% stake in Telefonic worth $2.25 billion, making it the Spanish telecom giant’s top shareholder.

👩⚕️ Medicine Money: Israel’s Pitango VC raised $175 million to close a health-care fund focused on areas including medical devices, Femtech and drug development.

🏨 Keys to Madrid: The Abu Dhabi Investment Authority (ADIA) completed a deal to buy two hotel portfolios comprising 17 properties in Spain for an undisclosed amount in a joint venture with Meliá Hotels International.

🔋 Powered Up: Oman’s sovereign wealth fund is adding to its growing list of green investments, picking up a minority stake in U.S.-based Our Next Energy, an energy storage company run by a former Apple exec, for an undisclosed amount.

🍞 Grain Savings: Egypt bought about half a million metric tons of Russian wheat in a private deal, negotiating lower prices than in traditional bidding, Reuters reports.

☁️ Cloud Protection: U.S. cybersecurity company Tenable agreed to pay $265 million to acquire Israel’s Ermetic, which develops software to protect cloud infrastructure.

🚌 Electric Buses: Egyptian Manufacturing Commercial Vehicles signed an agreement with Sweden’s Volvo to produce electric buses that will be exported to Europe.

🇨🇳 More Energy: Adnoc Gas signed a supply deal to PetroChina worth $450 million-$550 million, its latest foray into Asia after signing contracts following its IPO in India and Japan earlier this year.

🛍️ Brick and Mortar: Qatar Investment Authority bought a 1% stake in India’s largest retail firm, a subsidiary of Reliance Industries run by Mukesh Ambani’s daughter, Isha Ambani, for nearly $1 billion.

💵 Fair Trade: Abu Dhabi Exports Office (ADEX) inked a financing agreement with the National Bank of Egypt for a revolving loan of $100 million to support transactions of UAE exports to Egypt.

On the Circuit

Ursula von der Leyen, president of the European Commission, met with UAE President Sheikh Mohamed bin Zayed last Thursday to discuss areas of collaboration on a working visit to the UAE.

LeBron James, the NBA star, was spotted in Saudi Arabia last Thursday, just weeks after tweeting a joke about one day playing there.

Wang Chuanfu, CEO of China’s BYD, the world’s biggest maker of electric vehicles, was in Israel late last month on a secret visit to local distributor Shlomo Motors, Globes reports.

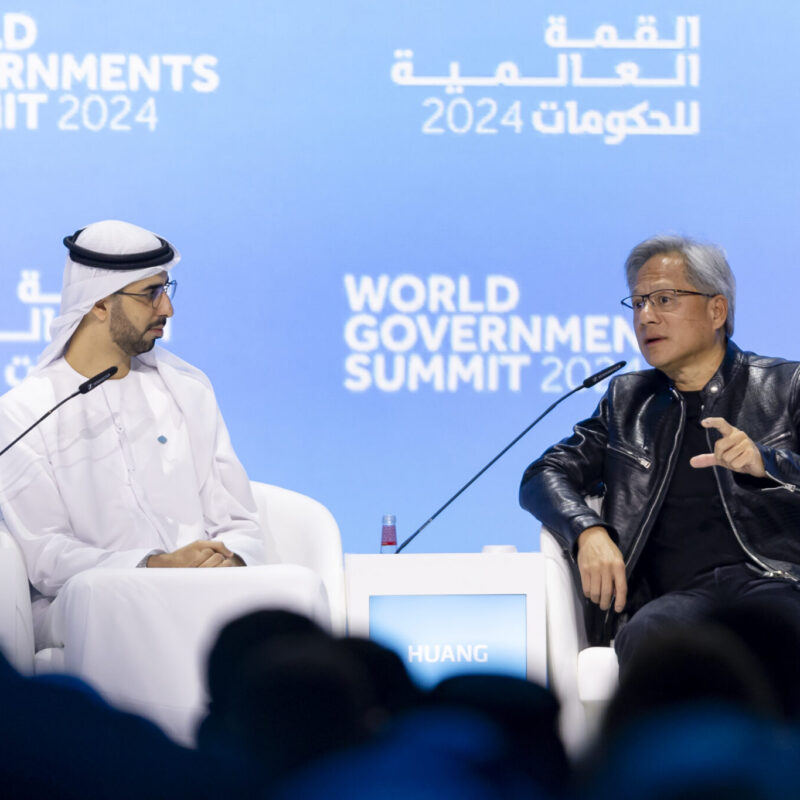

Omar Al Olama, the UAE minister of state for artificial intelligence, digital economy and remote work, was listed on Time’s List of 100 Most Influential People in AI.

Rani Raad, a former president of CNN Commercial Worldwide, was appointed CEO of Abu Dhabi-based media company International Media Investments.

Shai Aharonovitz was appointed as director of the Israel Tax Authority by Finance Minister Bezalel Smotrich, replacing Eran Yaacov, who served for five years.

Culture Circuit

Shared Prophet: Opening on Wednesday at the Louvre Abu Dhabi, “Letters of Light” is an exhibition presenting the holy books of the three Abrahamic religions – the Quran, the Christian Bible (Old and New Testaments) and the Hebrew Bible (Tanakh). On display are some of the most beautiful examples of the sacred texts ever made, and an exploration of how each religion spread across cultures and languages. Curated by Laurent Héricher, chief curator at Bibliothèque nationale de France and Dr. Souraya Noujaim, management director at Louvre Abu Dhabi. On display through Jan. 14, 2024.

On Location: Neom will be the site of another big-budget production. “Antara,” an upcoming historical drama directed by Simon West (“Lara Croft: Tomb Raider”)’, will be shot over 12 weeks at the megaproject in northwest Saudi Arabia, which offers a 40% cash rebate to projects that film there. Based on a true story, the film depicts the life of Antara ibn Shaddad, a sixth-century warrior who became one of the Arab world’s most celebrated poets.

Switching Fields: Saudi Arabia has reportedly ditched plans to bid for co-hosting duties of the World Cup with Egypt and Greece in 2030 and is drumming up support in Europe for its own bid for the tournament in 2034 at Neom. Qatar was the first Arab country to host the World Cup. Fan favorite Morocco will bid to co-host in 2030 with Spain and Portugal.

Ahead on the Circuit

Sept. 11-13, Riyadh, Saudi Arabia: Saudi Water Expo. Investors and leaders from industry and government discuss prudent use of the region’s water resources. Riyadh International Convention and Exhibition Centre.

Sept. 11-13, Tel Aviv, Israel: Jefferies Tech Trek. Investors meet tech executives at conference focused on Israeli startups. Kempinski Hotel.

Sept. 13, Washington, D.C.: Regional Impact and Future of the Abraham Accords. Atlantic Council’s N7 Initiative holds symposium on prospects for normalization between Israel and Arab states. Capitol Visitors Center.

Sept. 13-14, Dubai, UAE: Global Vertical Farming Show. Vertical farming companies from around the world meet with technology firms, policymakers and investors. Movenpick Grand Al Bustan Hotel.

Sept. 13-14, Riyadh, Saudi Arabia: IDC Saudi Arabia CIO Summit. Chief information officers explore new digital trends in business. Fairmont Riyadh Hotel.

Sept. 14-15, Abu Dhabi, UAE: Super Angels Summit 2023. Angel investors meet with startup founders at annual conference. Abu Dhabi National Exhibition Centre.

Sept. 19, Tel Aviv, Israel: Climate LaunchPad Israel. Competition showcasing 30 startups in climate and energy spheres. Microsoft Reactor, Midtown Building.

Sept. 19, Dubai, UAE: Middle East Investment Conference. Asset owners, managers, investors discuss latest trends in regional market. Ritz Carlton, DIFC.

Sept. 20-24, Dubai, UAE: Gitex Shopper. Electronics fair with product launches, presentations by major world brands. Dubai World Trade Centre.

Sept. 28-30, Jeddah, Saudi Arabia: Melody Festival. Three days of music honoring Saudi Arabia’s vibrant musical heritage and the artists who have shaped it. Jeddah Superdome.

Oct. 2-5, Abu Dhabi, UAE: ADIPEC 2023: Abu Dhabi International Petroleum Exhibition & Conference brings oil industry together to discuss trends and strategy. Abu Dhabi National Exhibition Centre.