Saudi Arabia pitching NEOM as a ‘generational investment’

Minister Khalid Al-Falih: 'If anybody expected NEOM to be a foreign investment in two, three or five years, then they have gotten it wrong'

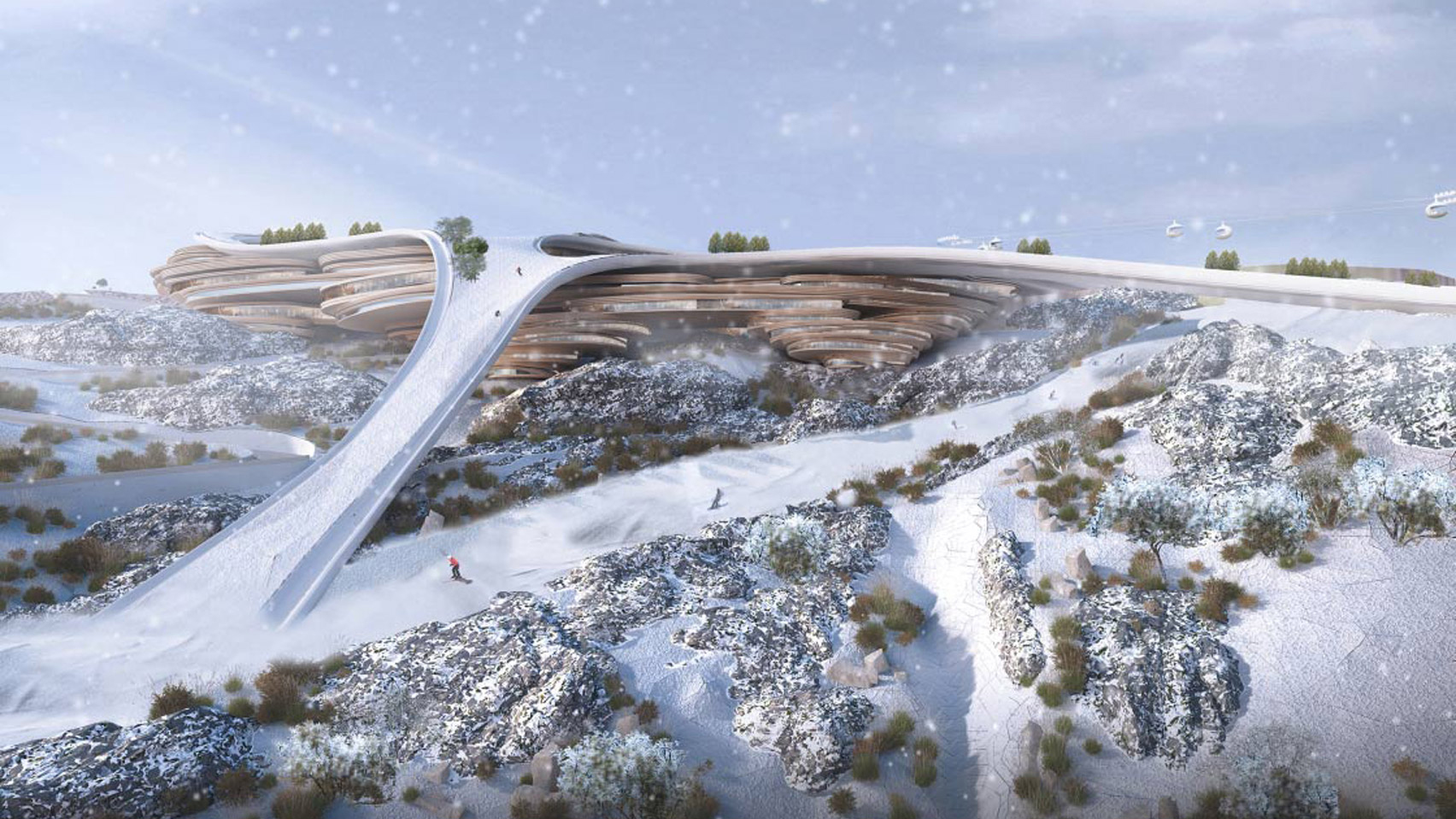

Artist's conception of NEOM's Trojena ski resort (NEOM)

Saudi Arabia is inviting the world to invest in its sprawling trillion-dollar NEOM megaproject and advising potential backers to ignore the recent bumps along the road.“The flywheel is starting and it will gain speed as we go forward, as...