Israeli tech startups gird for long-term decline in venture funding

Industry survey shows more companies are making plans to shift money and employees abroad amid warnings about government’s unpredictability

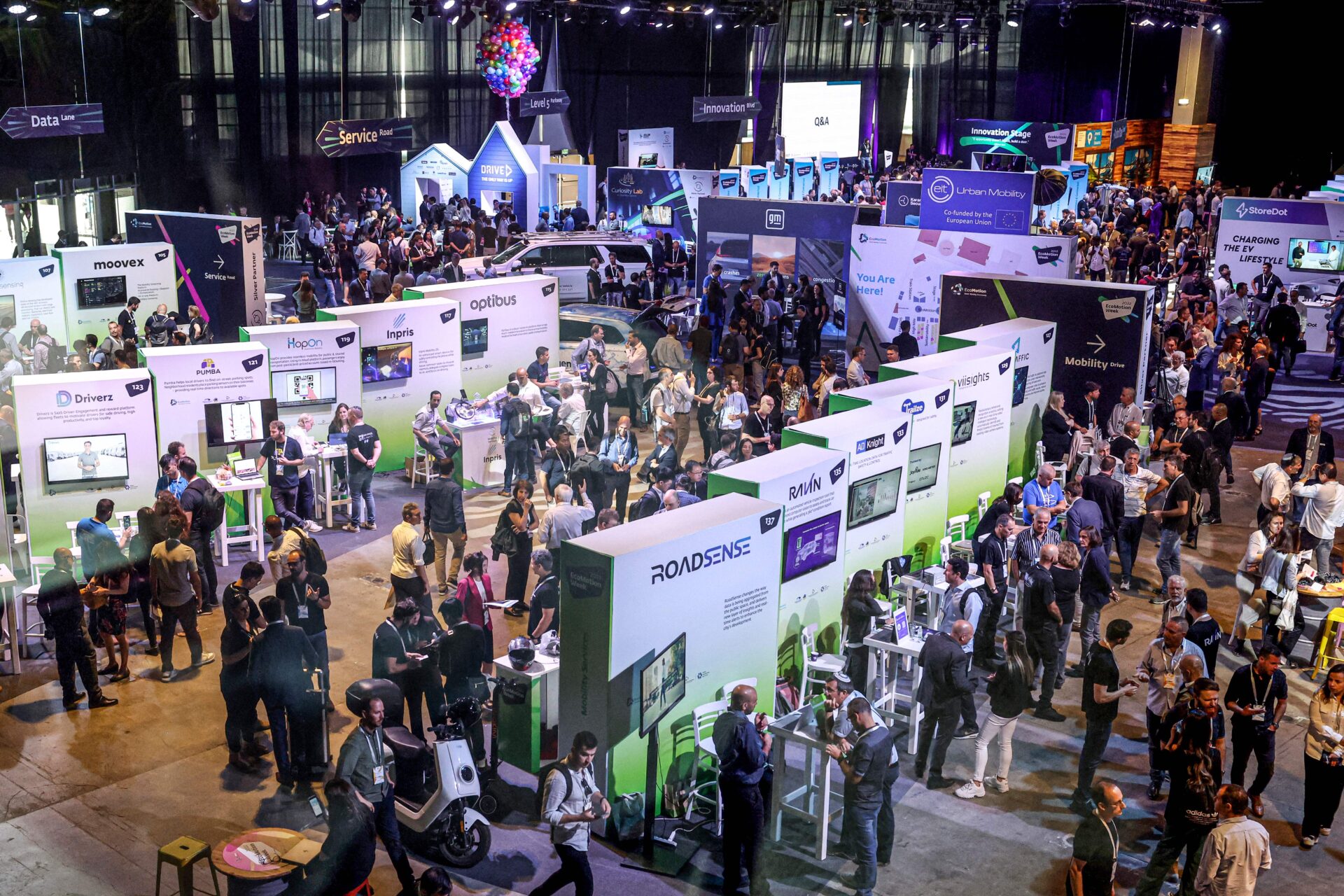

JACK GUEZ/AFP VIA GETTY IMAGES

Technology startups look for prospects at conference in Netanya, Israel

TEL AVIV, Israel — Israeli technology companies, the country’s economic engine and branding platform for three decades, are scraping for cash and trying to protect what they’ve raised by moving funds abroad.

While the government has temporarily paused its proposed judicial overhaul that led to a downgrade by Moody’s Investors Service of Israel’s economic outlook, startup founders are making contingency plans that include transferring key employee teams to other countries and shifting money from domestic accounts.

The concerns were reflected in a survey published this month by a nonprofit organization that has spent years cheerleading for Israel’s tech industry and promoting its potential value to new markets such as the United Arab Emirates, Bahrain and Morocco. Banking data from the first quarter of 2023 showed a 71% decline in startup investment from the same period last year.

“To move your capital outside Israel takes a phone call,” Avi Hasson, CEO of Start-Up Nation Central, which commissioned the survey, told The Circuit. “But if you’re moving projects or people outside of Israel, that’s a whole different ball game, both in the investment and effort needed to do it as well as the investment and effort needed to bring it back.”

The fact that some 90% of investment in Israeli tech startups comes from foreign sources indicates the pressure under which the company executives operate, said Hasson, formerly Israel’s chief scientist at the Ministry of Economy.

“The foreign capital is neither Zionist nor anti-Zionist,” he said. “It came to Israel based on the unique ideas, talent and ecosystem that are here and it will equally move out if it doesn’t feel that it has the conditions to generate exceptional returns.”

In its April 15 statement, Moody’s said downgrading the credit outlook “reflects a deterioration of Israel’s governance” under the coalition led by Prime Minister Benjamin Netanyahu that won election in November. “While mass protests have led the government to pause the legislation and seek dialogue with the opposition, the manner in which the government has attempted to implement a wide-ranging reform without seeking broad consensus points to a weakening of institutional strength and policy predictability,” Moody’s said.

Netanyahu, on the other hand, has sought to provide assurances that his government won’t harm the investment climate, pointing to his record as an economic reformer whose policies played a large role in building Israel’s reputation as a technology powerhouse. He minimizes the impact on the economy of the mass street protests against his proposed changes to the court system.

“Look, here’s what I think,” Netanyahu said in an April 19 interview with CNBC. “I think the future… belongs to those who innovate. I think the momentary fluff, the momentary dust that is in the air is just that — dust. The fundamentals of the Israeli economy are very powerful.”

Based on 1,142 responses from companies, investment firms and multinational corporations, the survey, published on April 13, demonstrated how operating abroad is increasingly seen as an option. It was conducted in the last week of March before Moody’s changed its outlook from “positive” to “stable” and warned that its credit rating may be cut if government policy becomes more unpredictable.

Among the findings, 46% of companies that responded are planning to move cash reserves outside of Israel, and 58% of those plan to transfer more than 50% of their money. About a quarter of the companies are considering plans to relocate employees out of Israel, and 42% are looking into changing their registration to another country.

Regarding current sentiment, 84% of investors and 80% of startups said they believe the judicial changes will have a negative effect on them and their portfolio companies. Similarly, 84% of investors expect the changes to have a negative effect on the ability of companies to raise capital from abroad, and 77% of companies believe it will be difficult to raise capital from foreign investors. Some 65% of the multinational companies polled expect a negative impact on their interest in piloting, buying or commercializing Israeli technology products.

Hasson expressed satisfaction with the pause in government efforts to push its judicial plan through the Knesset, Israel’s parliament, and said he hopes negotiations underway with opposition leaders will lead to a compromise that doesn’t deter investment.

“People are still developing products and selling them and so on,” he said. “I think the recovery capabilities of the ecosystem are really, really strong.”