AnD Ventures grooms start-ups as cash gets tougher to find

Edge Gaming, Onebeat among Israeli companies that raised money with young VC firm, which is building partnerships in New York and Japan

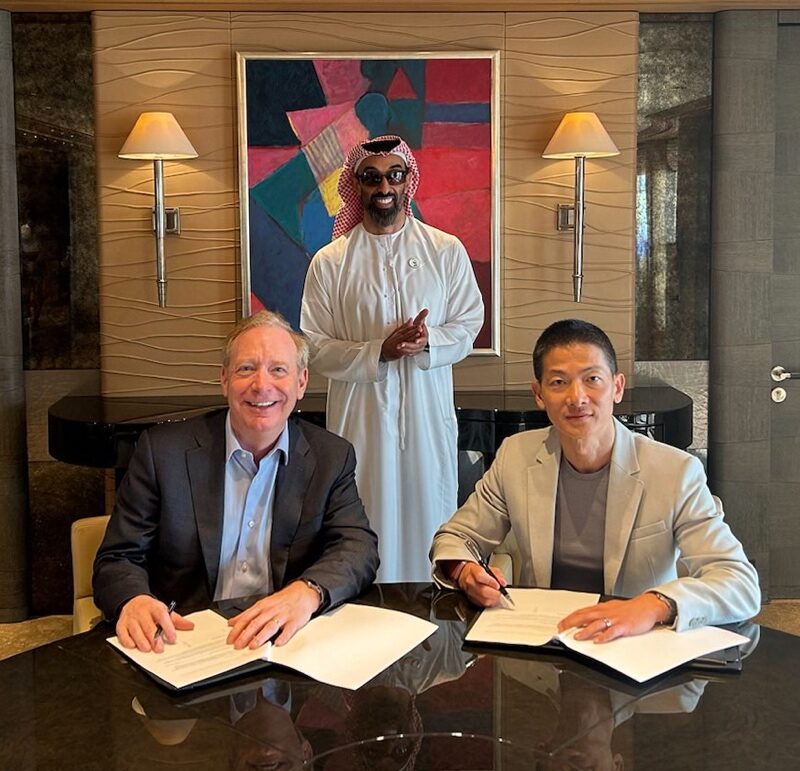

Courtesy

AnD Ventures co-founders Lee Moser and Roy Geva Glasberg at their office in Herzliya, Israel

When Lee Moser, Roy Geva Glasberg and Ariel Cohen, co-founders of AnD Ventures, went scouting for promising start-ups, they invited students from a small college north of Tel Aviv to come to them with business ideas.

Among the budding Israeli entrepreneurs they met through the school, the Interdisciplinary Center Herzliya, now known as Reichman University, were Asaf and Omri Granit. The two brothers needed funding for an e-sports company that helped players analyze their performance on the screen and send their favorite moves to friends. Over the next six months, Moser and Glasberg said they provided the Granit brothers with office space to develop the company, Edge Gaming, and worked with the duo on business fundamentals.

Since then, Edge has raised $42 million, built a team of 35 employees and opened offices in Israel, New York and Los Angeles. The company collected $30 million of that amount this month in a funding round led by Palo Alto, Calif.-based Corner Ventures. AnD, which invested in the initial seed round, also participated this time, along with Stardom Ventures and gaming heavyweight Playtika in Israel.

“These brothers were just amazing,” Glasberg said. “This is a company that jumped from a $4.2 million valuation to more than $105 million within a year and two months from when they started.”

It’s that kind of Cinderella story that propelled Moser and Glasberg to mold their firm into an incubator for early stage startups, providing guidance on hiring senior executives, business development and promotion to founders who have a promising concept.

In their portfolio are companies that include Onebeat, which develops logistics software for retailers; Connected Insurance, which provides coverage for e-scooters and other unconventional markets; and Ovio, a virtual currency exchange for gaming. AnD’s new headquarters in Herzliya, one of the main hubs for Israel’s tech industry on the Mediterranean shore, provides office space in its “Studio” area for companies while they mature.

“We bring companies here before they’re ready for VC investment,” Glasberg told The Circuit in an interview with Moser at the office. “They sit here with us, they work with us, we help them do the technical integration. We help them get the first customer, do the validation, all this stuff that VCs want in order to check the boxes. We do it with them hand-in-hand. And then we get to the point where, as a fund, we can choose to invest or not.”

Moser and Glasberg teamed up to form AnD Ventures (which stands for Advance and Develop) after previous careers in government and investing, respectively. Moser, 37, who grew up in Jerusalem, was chief of staff at the Israeli Embassy in Washington to former Ambassador Michael Oren. She later worked at iAngels, a Tel Aviv venture fund led by women, before joining Glasberg, who was her husband’s college friend at IDC Herzliya.

Glasberg, 46, who grew up in Ramat Gan, Israel, has degrees in law, business and software development, and held positions at Deloitte and Microsoft before moving to Google. There, he helped found and manage Google for Start-Ups and a variety of other accelerator programs, both in Israel and internationally.

Among AnD’s investors are Gary Ginsberg, who held senior communications jobs at Time Warner, News Corp. and SoftBank; Josh Fidler, a founding partner of Colorado-based Boulder Ventures; and Jay Rosensweig, a Canadian entrepreneur, corporate consultant and human rights activist.

Part of their challenge now is to help the young companies in their investment portfolio ride out the current financial slowdown that has pinched investment and forced many companies to start chopping expenses.

We’re trying to make sure they’ve got enough fuel to run longer than expected,” Glasberg said. “They need a backup plan for whatever happens, but on the flip side, there’s a lot of opportunities in the market.” Adds Moser, “There’s been a huge hype in the past two years, and maybe we will come back more to reality, valuation-wise.”

A key priority for the firm is preparing Israeli startup founders for the task of raising money internationally, particularly in the U.S. To that end, AnD Ventures announced a partnership last month with 25Madison, a venture capital firm in New York, to help groom its companies for making their cases to U.S. investors. AnD has a similar arrangement with Tokyo-based Ignition, providing startups in Israel and Japan with support in both countries.

Like other Israeli venture firms, Moser and Glasberg have been looking into potential opportunities in the United Arab Emirates and other Arab countries.

“We came in just to get to know people and see if there’s a long-term relationship we can build,” Moser said of their experience in the UAE. “It’s taking longer, but when and if it’s built, it will actually be built as something sustainable.”