The Weekly Circuit

👋 Hello from the Middle East!

As Saudi Arabia’s flagship investment summit opened this week, some 6,000 financiers, investors and business leaders filled the capital’s gilded Ritz-Carlton hotel and adjoining domed King Abdulaziz International Conference Center.

A hush fell over the crowd at the Future Investment Initiative gathering when Crown Prince Mohammed bin Salman strolled into the main hall on Wednesday with South Korean President Yoon Suk Yeol. The heir to the Saudi throne didn’t say a word, though, as audience members strained to get a look at him during the early afternoon session.

The Circuit’s Jonathan Ferziger and Kelsey Warner are reporting from the conference floor throughout FII’s three days of policy discussions, investment tips and high-powered networking. Here we bring you the sights, sounds and takeaways from seventh annual edition of the financial event known as “Davos in the Desert.”

After being admitted through the Ritz-Carlton’s monumental gate in Riyadh’s diplomatic quarter – the thousands of investment bankers roamed the Pavilion Hall under massive chandeliers, pitching deals while nibbling on petit fours and Khadary dates. Ringing the room were hospitality booths sponsored by Saudi Arabia’s Public Investment Fund, Red Sea Global resorts developer and Aramco, the world’s largest oil company, which invited guests to a computerized driving range and gifted them with branded golf balls.

As for the aim of the event, host Yasir Al-Rumayyan, governor of the kingdom’s $760 billion Public Investment Fund and chairman of Saudi Aramco, the world’s most valuable oil company, had a succinct message: the kingdom is open for business.

Welcome to The Weekly Circuit. Read on for the stories, deals and players driving the news across the MENA business landscape. Please send comments and story tips to [email protected].

Spread the word! Invite your friends to sign up.👇

DESERT DEBATES

Wall Street meets royal court at Saudi business summit

The captains of Wall Street met the princes of Saudi Arabia today at the kingdom’s annual gathering of the financial elite, The Circuit’s Jonathan Ferziger and Kelsey Warner report.

Fielding questions: Speakers on stage at the King Abdulaziz International Conference Center fielded questions on conflict in Europe and the Middle East, high interest rates, low growth and technological upheaval. Front and center was Saudi Arabia’s place in global markets.

High interest: “I believe many of the challenges” in current world economic conditions such as high interest rates “actually play to our strengths,” Saudi Minister of Investment Khalid al Falih said in the Future Investment Initiative conference’s morning session.

Investment spree: The kingdom’s $760 billion sovereign wealth fund has launched 90 new companies since 2017, beginning its investment spree with a mandate from Crown Prince Mohamed Bin Salman’s Vision 2030 economic transformation plan, which he introduced to the world investor class at the first FII conference seven years ago. Today, the Public Investment Fund is overseeing the development of the mega-project NEOM as well as major investments into alternative energy, aviation, telecoms. Forays into e-gaming and pro soccer and golf have grabbed headlines around the world.

Cameo appearance: Prince Mohammed, known internationally as MBS, sat beside South Korean President Yoon Suk Leol in ringside seats at the conference – which was arranged as a theater in the round – but he made no public comments.

HOT WHEELS

Abu Dhabi sets date for driverless race on Formula 1 Track seeking new competitions

The creator of ChatGPT is working with Abu Dhabi’s biggest artificial intelligence firm to scale up the availability of generative AI tools in the Middle East, The Circuit’s Kelsey Warner reports.

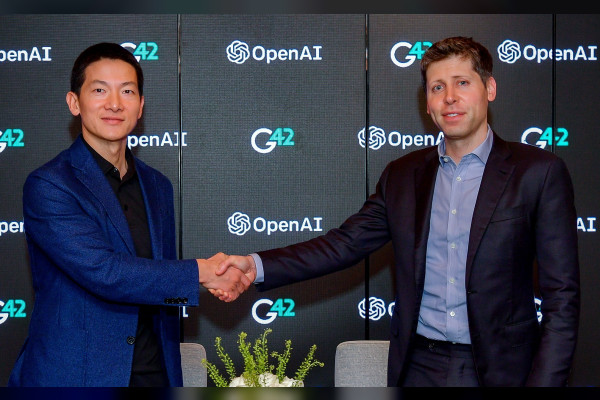

Local support: Mubadala-backed artificial intelligence firm G42 will use OpenAI’s large language models to build new products for clients in sectors where it is already active – financial services, energy and healthcare – and provide infrastructure capacity to support OpenAI’s local and regional inferencing on Microsoft Azure data centers. No financial details of the partnership were disclosed.

Altman speaks: “Leveraging G42’s industry expertise, we aim to empower businesses and communities with effective solutions that resonate with the nuances of the region,” Sam Altman, co-founder and CEO of the San Francisco-based company, said in a statement on Wednesday. G42 CEO Peng Xiao called the partnership “a convergence of value and vision.”

Capital gusher: Since becoming available to the public last year, OpenAI’s ChatGPT has inspired a gusher of investment into vast databases and neural networks to mimic human intelligence for commercial gain.

AI timeline: But the UAE was an early mover on AI. The country is set to reap the biggest economic boost in the region, with AI expected to contribute to 14% of GDP by 2030, according to a PwC study that the government often cites. In 2017 it released a strategic roadmap for integrating the then-nascent technology into its economy and regulation. In 2019, Abu Dhabi opened a dedicated AI research university. In 2020 G42 became the first UAE company to open an office in tech-heavy Israel after the Abraham Accords were signed, and within a year formed a joint venture with Israel’s state-owned Rafael Advanced Defense Systems to commercialize AI and big data technologies.

Click here to read the full story.

Sovereign Circuit

Public Investment Fund NEOM launched a strategic investment fund to seek capital to develop key sectors such as manufacturing, tourism and food security in the 10,230 square-mile greenfield mega-project on the Red Sea coast. The kingdom’s sovereign wealth fund is the anchor investor in NEOM, with the first phase of the project running until 2030 and costing $319 billion, with about half covered by the PIF.

Hong Kong architecture firm Aedas has been tapped for The Red Palace project in Riyadh, one of three royal palaces Boutique Group, a wholly owned hospitality subsidiary of the PIF that is transforming into luxury hotels in the kingdom.

The PIF is mulling a public listing of the country’s largest medical procurement firm, Nupco, as early as next year, Bloomberg reports, amid robust capital markets activity in the Gulf. The sovereign wealth fund has listed some of its portfolio companies on the local Tadawul exchange in recent years, including Americana Restaurants International, Arabian Drilling Company and utility company Marafiq.

ADQ PureHealth, the UAE’s biggest healthcare provider, rolled out a new cloud service to connect healthcare providers and digitize health records called PureNet. PureHealth is marketing the platform to hospitals and clinics in the country and internationally. The entity was formed in January 2022 by consolidating several companies under the Abu Dhabi-backed holding company ADQ, which became its largest shareholder.

Mubadala Invest AD, a subsidiary of Abu Dhabi’s second-biggest sovereign wealth fund Mubadala Investment Company, launched a private credit fund with Blackstone to offer access to qualified UAE investors to Blackstone’s U.S. and European private credit platforms.

Ras Al Khaimah Investment and Development Office Sheikh Khalid bin Saud Al Qasimi, vice chairman of Ras Al Khaimah’s IDO, attended the launch event for RAK Digital Assets Oasis, a commercial free zone dedicated to digital and virtual assets companies in the northernmost emirate of the UAE. IDO was established in 2004 as a long-term active investor, specialized in managing the financial performance of all government entities.

Circuit Chatter

💰 Gulf Fever: Brookfield, the Canadian global dealmaker, is exploring options for raising funds to invest in private equity buyouts and real estate in the Gulf, Bloomberg reports.

🏦 Risky Business: Moody’s alerted Bank Leumi and Israel’s four other top lenders that they are under review for a downgrade, citing risk exposure to the Gaza war.

💻 9 to 5: A survey of GCC workers found that the majority would leave their current jobs simply for better benefits.

🎭 Theatrical Dining: A Jazz Age-inspired restaurant called Broadway has opened at the Mandarin Oriental Emirates Palace in Abu Dhabi.

🎮 Next Level: Saudi Arabia plans to host an annual Esports World Cup in 2024 amid massive investment into gaming by the kingdom as it seeks to create jobs and boost tourism.

🛫 Flight Fright: Airlines outside the Middle East are being affected by the Gaza conflict and may face flight restrictions, Virgin Atlantic CEO Shai Weiss tells Bloomberg.

🤖 Smart Share: Investment firm Thrive Capital, founded by Joshua Kushner, is reportedly leading a deal to buy OpenAI employee shares giving the company a paper valuation of at least $80 billion, The Information reports.

Closing Circuit

🏢 City-builder: Saudi Arabia’s NEOM is setting up a $10 billion joint venture with Danish freight forwarder DSV A/S to develop the futuristic desert city.

🔥 Heating Up: Ormat, an Israeli company that makes geothermal heating equipment, bought the geothermal and solar energy assets of six U.S. companies for $271 million.

🏠 Homeward Bound: Nomad Homes, a property-tech startup catering to the UAE and Europe, raised $20 million in a funding round led by California-based Acrew Capital.

💰 Share Sale: Investcorp Capital plans to sell a 29% stake and list on the Abu Dhabi exchange, using proceeds to develop its financial services business.

💻 Tech Fund: KKR closed on its $3 billion Next Generation Technology Growth Fund III, which is focused on investments in North America, Europe and Israel.

🇪🇬 Debt Service: China signed a preliminary agreement to help Egypt finance a series of development projects and help chip away at its $165 billion mountain of external debt.

🪖 Ratings Warning: Moody’s placed Israel’s bond ratings under review, warning that war in Gaza could harm the economy and lead to a downgrade.

On the Circuit

Greg Norman, CEO of LIV Golf, told reporters at Trump Doral he has zero concern for the league’s future or his role in it.

Abdulla bin Touq, the UAE’s Minister of Economy, called for boosting cooperation among Middle East countries to build tourism, speaking at the UN World Tourism Organization’s general assembly in Samarkand, Uzbekistan.

Tarek Amin, former CEO of Japan’s Rakuten Mobile and Rakuten Symphony, has been tapped as CEO of Aramco Digital, a business set up recently by Saudi oil giant Aramco.

Dana White, CEO of Ultimate Fighting Championship, called Abu Dhabi “one of my favorite places in the world” as he signed an agreement to extend a partnership – including more Fight Nights – with the emirate through 2028.

Adam Neumann, the founder of Flow, who hopes to disrupt the residential real estate industry like he did the office market with WeWork, held a pitch session for startups yesterday at the FII conference in Riyadh.

Akbar Al Baker, CEO of Qatar Airways for 25 years, is stepping down in November, to be succeeded by Badr Mohammed Al Meer, COO of Doha Hamad International Airport.

Culture Circuit

📐 Well Built: The Sharjah Architecture Triennial, a forum and exhibition in the bustling and historic emirate north of Dubai, announced the dates and first participants for “The Beauty of Impermanence: An Architecture of Adaptability” which runs from Nov. 11 to March 10, 2024. The triennial will address the theme of scarcity in the Global South and the culture of re-use and adaptation that has sprung up as a result, according to organizers. Curator Tosi Oshinowo is bringing together works from international architects and designers to include public installations and collaborative projects that examine the theme within the cultural and historic context of Sharjah.

Ahead on the Circuit

Oct. 29-31, Riyadh, Saudi Arabia: Global Health Saudi. A gathering of Saudi and international players in health care and medical devices. Riyadh Front Exhibition & Conference Center.

Oct. 30-31, Dubai, UAE: AIM Summit. A meeting of leaders from the alternative investment industry including hedge funds and private equity to discuss market trends and opportunities. Jumeirah Emirates Towers.

Oct. 31-Nov. 1, Abu Dhabi, UAE: Abu Dhabi Smart City Summit. Bringing together key government and private organizations to collaborate and discuss initiatives and technology requirements to make Abu Dhabi a leading global smart city. Conrad Hotel.

Nov. 2, Dubai, UAE: Fast Company World Changing Ideas Summit. A gathering of government officials, venture capitalists and social entrepreneurs to discuss innovation trends in the Middle East. Dubai Museum of the Future.

Nov. 13-17, Dubai, UAE: Dubai Airshow. One of the largest gatherings of the aviation and aerospace industries in the world featuring live aircraft demonstrations. Dubai World Central.

Nov. 15 & 16, Riyadh, KSA. Misk Global Forum. The biggest youth gathering in the region, hosted by the Mohammed Bin Salman Foundation, this year under the theme “The Big Now” to encourage young people to think ambitiously and act quickly. Bujairi Terrace.

Nov. 17-19, Manama, Bahrain. IISS Manama Dialogue. A unique forum for government ministers and policymakers, as well as the private sector, to debate the Middle East’s most pressing foreign policy, defense and security challenges. The Ritz Carlton.