The Weekly Circuit

👋 Ramadan Mubarak from the Middle East!

This week we’re looking at Dubai-based Telegram’s potential IPO, the Jada Fund of Funds’ support for venture debt in Saudi Arabia, a Jordanian startup’s alliance with Visa and Asharq News’s AI anchor. But first, Gulf sovereign wealth funds are casting a bigger shadow.

The conference circuit has given way to the Iftar and Suhoor circuits in the Gulf with the beginning of Ramadan this week. The Holy Month typically brings about one of the quietest times for deal activity and events in the region as hours are shortened for workers across sectors to make room for daylong fasting and more time spent with family. However, the region’s sovereign wealth funds have shown no signs of slowing.

Abu Dhabi launched a massive investment company on Monday helmed by some of its biggest business leaders. The move adds a piece to the chess board in the global competition to develop advanced technology and secure the infrastructure needed to power it. The Artificial Intelligence and Advanced Technology Council on Monday announced MGX, a new investment company focused on three themes: AI infrastructure, semiconductors and core technology like software, life sciences and robotics.

The emirate’s sovereign fund Mubadala Investment Co. and AI firm G42 are founding partners. MGX will be chaired by UAE National Security Adviser Sheikh Tahnoun bin Zayed, who also chairs ADQ and ADIA, with Mubadala CEO Khaldoon Al Mubarak acting as MGX’s Vice Chairman. Board members include UAE Central Bank Vice Chairman Jassem Al Zaabi and G42 CEO Peng Xiao.

Saudi Arabia’s Public Investment Fund meanwhile, took a leap this week toward its stated goal of becoming a $1 trillion wealth fund by 2025 with the $164 billion stake in Aramco transferred to the PIF. The deal puts the Middle East on track to becoming the only region with three trillion-dollar sovereign funds, Bloomberg reports, with the Kuwait Investment Authority penciling one of its best years on record and Abu Dhabi Investment Authority tallying $993 billion in assets under management (according to data from the Sovereign Wealth Fund Institute).

Government-linked capital has underpinned dealmaking in the Gulf for the last five years, according to Pitchbook, which released its 2023 figures for the MENA region. In 2023, the UAE represented 45% of private equity deal value and 24% of deal volume – equivalent to $7.1 billion across 50 deals. Despite the UAE topping overall deal activity statistics, the largest deal in 2023 involved SABIC divesting its Saudi Iron and Steel unit to the PIF for $3.3 billion, according to Pitchbook.

Dubai-based Telegram, an encrypted messaging platform, is nearing profitability and mulling an initial public offering, its owner told the Financial Times in an interview. Pavel Durov said the app has over 900 million users and is making “hundreds of millions of dollars” in revenues after introducing advertising and paid subscriptions two years ago. “We are hoping to become profitable next year, if not this year,” said the Russia-born founder in his first public interview since 2017. He said he has ruled out selling the platform while he explores a potential blockbuster IPO.

Welcome to The Weekly Circuit. Read on for the stories, deals and players at the top of the news across the MENA business landscape. Please send comments and story tips to [email protected].

HIGH RISK

Nuvo, a maker of remote fetal monitors, prepares for Wall Street debut

Across the U.S., doctors and healthcare companies are trying to address the spread of “maternity care deserts,” large swaths of the country suffering from a shortage of obstetricians and nursing staff, The Circuit’s Jonathan Ferziger reports.

Philips test: Two years ago, health technology giant Philips teamed up with a small Israeli startup called Nuvo Group to judge whether its remote fetal monitoring equipment could help. The pilot program conducted with women in rural parts of Colorado whose pregnancies were termed high-risk ultimately persuaded Philips to strike a distribution agreement with Nuvo.

$30 million: The device’s ability to provide accurate information, assisted by artificial intelligence, is also propelling the company to its debut in the next two months on the Nasdaq stock market. Going public in a SPAC, Nuvo hopes to raise at least $30 million, CEO Rice Powell told The Circuit.

Click here to read the full story.

GOOD SCENTS

Saudi scientists develop sustainable oudh, aroma of the Arab world

The distinctive woody scent of oudh has been prized in the Middle East for thousands of years, but deforestation and overharvesting of agarwood means it is becoming an increasingly rare and expensive ingredient for perfumers, Louise Burke reports for The Circuit.

High-tech solution: Scientists at King Abdullah University of Science and Technology (KAUST) in Saudi Arabia have developed a sustainable alternative to wild agarwood, using metabolically engineered algae to produce a synthetic version of the oudh scent.

Conscientious consumers: “The allure of the Middle East is always talked about as an olfactory response. I think there is a wonderful potential here for it to be well received with that next generation of consumers,” Assistant Professor Kyle Lauersen, who led the team of researchers, said.

Click here for the full story.

💲 Sovereign Circuit

Abu Dhabi Investment Authority: The sovereign wealth fund is raising its commitment to London-based Cheyne Capital’s real estate private credit fund to $831 million.

ADQ: Lunate, the ADQ-backed investment management fund, has partnered with JP Morgan Chase & Co. on the first exchange-traded fund tracking the performance of bonds in the UAE. The Chimera JPMorgan UAE Bond UCITS ETF will list on the Abu Dhabi Stock Exchange on March 26. Unifrutti, a unit of ADQ reached a deal to buy Peru’s AvoAmerica and Bomarea from U.S.-based Solum Partners and Alpine Fresh.

Mumtalakat: Bahrain’s sovereign wealth fund, which owns 50% of McLaren, has reportedly hired bankers to find a buyer for their stake in the struggling luxury British carmaker.

Mubadala: Mubadala has become an anchor investor in U.S.-based fund-of-funds venture capital firm Blue Opal Capital’s second VC fund. Only one venture capital mega-fund — defined as over $500 million — closed last year in the MENA region, courtesy of Mubadala‘s more than $710 million Brazil Special Opportunities Fund II, according to new data from Pitchbook.

Public Investment Fund: Jada Fund of Funds, a subsidiary of the PIF, is investing in a $266 million fund to support the growth of the venture debt ecosystem in the kingdom. The investment in Partners for Growth VII, managed by U.S.-based global private credit manager Partners for Growth, is the first investment by Jada in venture debt and its second in the private credit space. Saudi Arabia’s pro soccer club Al Hilal nabbed 28th straight win in competitive games on Tuesday, setting a world record for a top-tier team. Al Hilal’s dominating season follows the club spending about $380 million on player transfers. Ceer, the Saudi Arabian electric vehicle company backed by the PIF, will develop a $1.3 billion manufacturing facility in the kingdom’s King Abdullah Economic City.

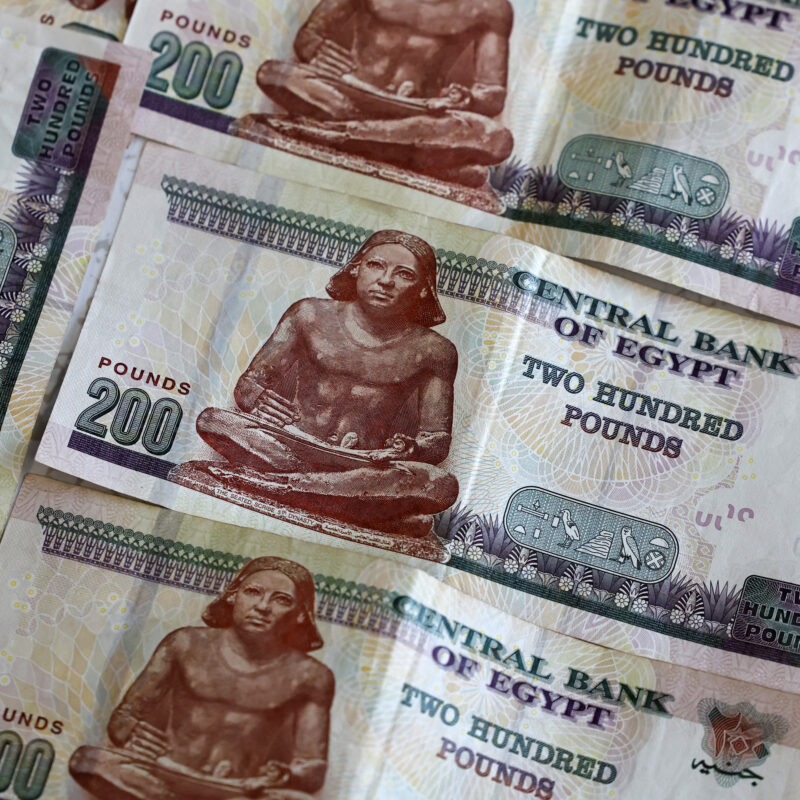

Qatar Investment Authority: Sionna Therapeutics, a Boston-based healthcare firm working on a treatment for cystic fibrosis, raised $182 million in a Series C funding round led by Enavate Sciences with participation from the QIA. The QIA reinitiated talks to buy the government’s 45% stake in Vodafone Egypt, Daily News Egypt reports.

🗣 Circuit Chatter

💸 E.U. Raft: The E.U. is preparing a €7.4 billion ($8 billion) aid package for Egypt aimed at shoring up its economy, the Financial Times reports. European Commission president Ursula von der Leyen will travel to Cairo on Sunday with the Greek, Italian and Belgian prime ministers to finalize and announce the agreement.

🚍Electric Buses: Qatar is planning to have a 100% electric fleet in its public bus lines by 2030, according to the Ministry of Transportation.

🚁 Flying Cars: The UAE’s Falcon Aviation and California-based Archer Aviation signed a deal to create a “flying car” route between Dubai and Abu Dhabi that will start in 2025.

📝 Freelancer Finance: Numa, a Jordan-based fintech company focused on freelancers and solo entrepreneurs, said it will collaborate with Visa to fuel its expansion plans in Saudi Arabia.

🎥 Very Entertaining: U.S. private equity firm Apollo Global Management is in talks with Paramount Global about a possible takeover as the entertainment and media conglomerate works out how to confront a massive debt pile, Axios reports.

🗞️ Enter Murdoch: Rupert Murdoch’s News Corp. and the owner of the Daily Mail have held talks about a potential joint takeover of the Telegraph alongside the UAE-backed investment fund RedBird IMI, Bloomberg reports. Meanwhile, U.K. Prime Minister Rishi Sunak is considering changes to the law to block the sale agreement entirely, the Financial Times reports.

🌍 Green Energy: The Moroccan government said it will dedicate 1 million hectares (2.5 million acres) of land to green hydrogen projects and become a player in the renewable energy market.

↪↩ Closing Circuit

🚗 Extra Demand: Parkin, Dubai’s municipal parking company, said it would increase the number of shares offered in next week’s IPO by 2% because of exceptional demand from retail investors.

⚰️ Mortality Guide: Empathy, an Israeli startup that helps people deal with funeral costs and other death-related issues, announced it completed a $47 million Series B funding round, led by Index Ventures with participation from General Catalyst, Entrée Capital, Latitude, and Brewer Lane. The company also received strategic investments from six major life insurance firms – Allianz, MassMutual, MetLife, New York Life, Securian and Sumitomo.

🔒 Data Control: Cyera, an Israeli data security startup, expects to raise as much as $200 million in a funding round nearing its close that would triple the company’s valuation to over $1.5 billion, according to Business Insider.

🏗️ Infrastructure Spending: Abu Dhabi’s Executive Council approved 144 infrastructure projects worth $18 billion, with the focus on housing, education, tourism and natural resources.

💰 Debt Deal: Investcorp Capital has entered into a $800 million revolving credit facility agreement with a syndicate of regional and international banks to repay an intercompany transaction and to support its investment strategy, according to a bourse filing on Monday.

💰 Raising Funds: Wiz, an Israeli cybersecurity startup, is in talks with Sequoia, Thrive and Light Speed Venture Partners to raise as much as $800 million, the Financial Times reports.

🕋 Sacred Property: Saudi Arabia’s holy cities of Mecca and Medina are drawing high-net-worth Muslim property buyers, who plan to invest $2 billion in the markets, a Knight Frank report says.

🌍 Power Circuit

Sheikh Mansour bin Zayed, Vice President, Deputy Prime Minister and Chairman of the Presidential Court, presided over a meeting of the Ministerial Development Council on Tuesday, discussing regulation of industries ranging from pharmaceuticals to electric vehicles.

UAE President Sheikh Mohamed bin Zayed had a call on Monday with Ursula von der Leyen, President of the European Commission, where they discussed cooperation between the UAE and the E.U. The president also spoke by phone with Nikos Christodoulides, President of Cyprus, on the same day.

Sheikh Abdullah bin Zayed, UAE Minister of Foreign Affairs, met with Mélanie Joly, Minister of Foreign Affairs of Canada, in Dubai over the weekend.

UAE President Sheikh Mohamed bin Zayedordered the release of 735 inmates from correctional facilities ahead of the Holy Month of Ramadan. Sheikh Mohammed bin Rashid, UAE Prime Minister and Ruler of Dubai, ordered the release of 691 prisoners. Sheikh Saud bin Saqr Al Qasimi, Ruler of Ras Al Khaimah, ordered the release of 368 prisoners.

➿ On the Circuit

Asharq News anchor Hadil Eleyan has a new multilingual AI lookalike, who debuted on Monday with an on-air conversation between the two. Besides Arabic, Eleyan’s AI double can deliver the news in Russian, Spanish and Mandarin.

Munerah Al-Rasheed has been elected by the World Customs Organization to head up its Regional Intelligence Liaison Offices for 2025 and 2026, becoming the first Arab woman to lead the office, the Saudi Press Agency reported on Tuesday.

Sheikh Mohammed bin Faisal Al Qassimi received unanimous Board approval to become Chairman of Sharjah-based United Arab Bank, succeeding Sheikh Faisal bin Sultan Al Qassimi, who held the post for nearly 50 years.

Dr. Sultan Al Jaber, UAE Minister of Industry and Advanced Technology, COP28 President and Group CEO of ADNOC, met in Greece on Sunday with Prime Minister Kyriakos Mitsotakis to discuss sustainable investments and economic cooperation. Abu Dhabi’s Mubadala Investment Co. and Greece’s Hellenic Development Bank of Investments signed a preliminary agreement to inject an additional 200 million euros ($219 million) into their existing partnership.

🎶 Culture Circuit

📱 Ramadan Clips: TikTok is collaborating with Saudi creative studio Telfaz11 to create an exclusive Ramadan series, marking the platform’s first-ever episodic branded content series. One of the shows invites TikTok users to join two agents on daring adventures.

⚽ Goal Getters: UAE club Al Ain has secured a place in the Asian Champions League semi-finals after dramatically beating Portuguese star Cristiano Ronaldo’s Al Nassr on penalties at Al-Awal Park Stadium in Riyadh on Monday night. Al Ain will face the winner of Tuesday’s quarter-final between Saudi’s Al Ittihad and Al Hilal. It is the first time Al Ain, the UAE’s only winner of the Asian Champions League in 2003, has advanced to the final four since 2016.

📷 Photo of The Week

📅 Ahead on The Circuit

March 14-15, Cannes, France: Saudi Talks. Saudi Arabia brings more than 20 government and industry figures to discuss the kingdom’s real estate sector at MIPIM, the world’s largest real estate event. Palais des Festivals.

Apr. 16-17, Abu Dhabi, UAE. Green Hydrogen Summit 2024. Bringing together experts, policymakers, and industry leaders to explore opportunities and the industry’s future. Abu Dhabi National Exhibition Center.

Apr. 16-18, Abu Dhabi, UAE: World Future Energy Summit 2024. A platform to showcase the solutions to some of the most critical challenges identified at COP28. Abu Dhabi National Exhibition Center.

Apr. 16-18, Dubai, UAE. Middle East Energy. Energy leaders gather to debate and shape the future. Dubai World Trade Center.

Apr. 23-25, Dubai, UAE: GISEC Global. A forum for furthering the key discussions that are helping to define cyber resilience and connecting the global cybersecurity community. Dubai World Trade Center.

Apr. 29-May 1, Riyadh, Saudi Arabia: Future Hospitality Summit. An international gathering hosted in cities around the world bringing together the most influential hospitality investors and developers. Mandarin Oriental Al Faisaliah.

Apr. 29 – May 5, Abu Dhabi, UAE: Abu Dhabi International Book Fair. A key event for the publishing industry in the Middle East and North Africa. Abu Dhabi National Exhibition Center.

Apr. 30-May 1, Abu Dhabi, UAE: Mobility Live. A conference and exhibition sponsored by the Abu Dhabi transport regulators, gathering disruptive technology developers in transportation and the public sector. Abu Dhabi National Exhibition Center.

Apr. 30-May 1, Abu Dhabi, UAE: Middle East Rail. The leading conference in the region for rail innovation, technology and strategy. Abu Dhabi National Exhibition Center.