The Weekly Circuit

👋 Hello from the Middle East!

Environmental activists, energy industry chiefs, investors and policymakers are making their way to Dubai by the thousands for Thursday’s opening of COP28, this year’s edition of the annual United Nations climate change summit, The Circuit’s Kelsey Warner reports from the UAE.

Hosted by UAE President Sheikh Mohamed bin Zayed Al Nahyan and Dr. Sultan Al Jaber, Minister of Industry and Advanced Technology, who is President of COP28 and head of both the UAE’s national oil producer and renewables company, the two-week event at Dubai’s Expo City is expected to draw a long roster of global leaders.

Among the key speakers will be Britain’s King Charles III, Ukraine President Vlodomyr Zelensky, French President Emmanuel Macron and Brazil’s Luiz Inácio Lula da Silva. Israeli President Isaac Herzog is scheduled to address the conference, but his presence is still a question mark because of security concerns stemming from the Gaza war.

The Vatican sent regrets for 87-year-old Pope Francis who is recovering from the flu and President Joe Biden dispatched Vice President Kamala Harris in his stead after attending the past two summits in Egypt and Scotland. Chinese President Xi Jinping and Russian President Vladimir Putin are also likely no-shows.

More than 100 heads of state are slated to deliver three-minute speeches outlining their targets for phasing out fossil fuels and reaching net-zero carbon emissions. Negotiations on producing consensus goals from COP28 will also focus on the level of funding by wealthier countries to help the developing world battle climate change.

“The urgency of this mission cannot be overstated, for the window of opportunity to limit climate change by transitioning to a green global economy is rapidly closing,” Saeed Mohammed Al Tayer, vice chairman of the Dubai Supreme Council of Energy and CEO of the Dubai Electricity & Water Authority, said on Tuesday in an address to the World Green Economy Summit in Dubai.

Click here to read the full story.

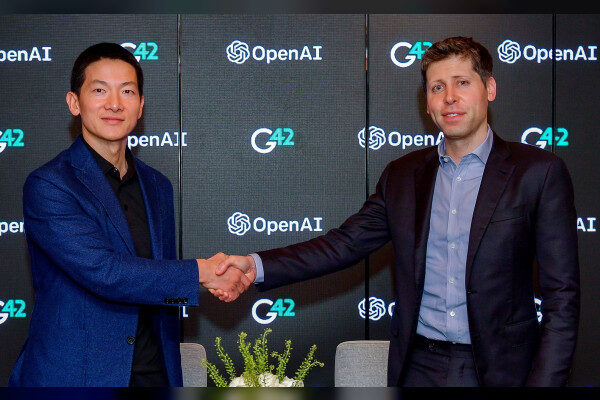

And in Abu Dhabi, leading venture capitalists addressed the Fortune Global Forum on Wednesday at the Emirates Palace hotel where they discussed how to unlock the MENA region’s innovation potential. (See more below.) The panel featured Mubadala Capital’s Ibrahim Ajami, Global Ventures’ Noor Sweid, OurCrowd’s Jonathan Medved, 500 Global’s Courtney Powell, and Hisham Halbouny from P1 Ventures. Earlier in the day, attendees heard from Bridgewater founder Ray Dalio, UAE Trade Minister Dr. Thani Bin Ahmed Al Zeyoudi, G42 CEO Peng Xiao, Lazard’s Peter Orzag and Franklin Templeton’s Jenny Johnson, among others.

Welcome to The Weekly Circuit. Read on for the stories, deals and players driving the news across the MENA business landscape. Please send comments and story tips to [email protected].

AI Safety

G42 CEO hits back at allegations UAE’s AI alliances expose it to geopolitical risk

The head of Abu Dhabi’s artificial intelligence firm G42 responded to allegations that its customers in China expose the UAE to geopolitical risk, following a New York Times report that the C.I.A. has been probing G42’s work with U.S.-sanctioned Chinese telecom giant Huawei and other customers.

Got Gist: G42 CEO Peng Xiao said at the Fortune Global Summit in Abu Dhabi on Wednesday that he did not read the Times article but “got the gist.” He said frameworks are in place to protect data privacy and data classification, and that the safety of its AI systems is “fairly well addressed” to prevent prying eyes, but did not go into specifics.

No Leakage: Referencing G42’s partnership with U.S. firm Cerebras Systems, which recently built the first of nine AI supercomputers in partnership with G42, he said, “when we ship our Arabic data to be trained on its supercomputers in California, there is no data leakage.”

Ground Zero: Speaking after Xiao at the conference, Ibrahim Ajami, head of ventures at Mubadala Capital, suggested that attention should stay focused on the U.S. “The ground zero for AI, some might debate, is China,” Ajami said. “It’s not. It’s Silicon Valley.”

Click here to read the full story.

Sovereign Circuit

Public Investment Fund: The PIF struck a share purchase agreement to buy a 10% stake in TOPCO, the holding company of London’s Heathrow Airport Holdings. The PIF-backed Jada Fund of Funds Company announced its first investment in private credit with an investment in Ruya Partners’ $250 million fund. Saudi Arabia’s Kingdom Holding Co., in which the PIF has a 16.9% stake, bought shares in Citigroup from its chairman, Prince Alwaleed bin Talal, for $450 million. The purchase increased Kingdom’s ownership in Citigroup from 1.6% to 2.2%.

Qatar Investment Authority: The QIA is investing $50 million in Global Dental Services, which operates more than 400 dental clinics across India, as part of the sovereign fund’s strategy to extend its international finance activities.

ADQ: PureHealth, the UAE-based healthcare platform majority owned by ADQ, launched a new digital pharmacy designed to help manage their medications, including delivery of individually sealed packs containing all of a client’s prescribed pills for each day.

Mubadala: While its U.S. investments top $100 billion, Mubadala intends to significantly increase its holdings in China, Waleed Al Muhairi, the fund’s deputy group chief executive, said in remarks at Abu Dhabi Finance Week on Monday.

Circuit Chatter

🇸🇦 World’s Fair: Saudi Arabia won the rights to host Expo 2030 in its capital city of Riyadh. The Saudi bid garnered 119 votes compared to just 29 for South Korea and 17 for Italy at a meeting on Tuesday of the Bureau International des Expositions in Paris

🛢️Oil Dispute: OPEC+ may postpone its Nov. 30 policy meeting amid a dispute with Angola and Nigeria, which are holding out against efforts to lower production quotas.

🏛️ Financial Guidance: Abu Dhabi is setting up a program with local banks to give small and medium-sized businesses guidance and greater access to financial services.

🧳 Speedy Check-In: Abu Dhabi Airport is introducing biometric technology designed to let passengers get to their gates within 12 minutes of entering the new Terminal A.

💵 Gulf Banking: JP Morgan will expand its corporate banking and payment services in Abu Dhabi, CEO Jamie Dimon announced by video link at Abu Dhabi Finance Week.

💲Asset Manager: Vibrant Capital Partners, a New York-based investment firm with $8 billion in assets under management, is opening an office at the Abu Dhabi Global Market focusing on international business.

💱 Egyptian E-Pounds: Egypt’s central bank is studying a proposed digital currency that could be used for mobile phone transactions and reduce the need to print banknotes.

Closing Circuit

🎲 Casino Island: Dubai developer Wasl awarded China State Construction Engineering Corp. a $1.2 billion contract to build an artificial island housing MGM and Bellagio hotels that would become a casino resort if gaming is legalized, MEED reports.

🖇️ Expense Control: CapitalOS, an Israeli startup focused on spending management for businesses, raised $9 million in seed capital and $30 million in debt financing.

🇪🇬 Egyptian Logistics: Dubai-based DP World started construction on an $80 million logistics park in Egypt’s Red Sea industrial and tourism hub of Ain Sokhna.

🏡 Fancy Living: Dubai is proving immune to a global slowdown in the luxury real estate market, leading the world in third-quarter sales of homes worth more than $10 million.

💶 Smart Money: Yabi by Souqalmal, a Dubai-based startup that teaches financial literacy, raised $8 billion in a seed funding round from Shuaa Capital and Wafra II.

💻 Online Investing: Oman’s Bank Muscat Asset Management said it will make its top-performing mutual funds available for online investment.

📈 Derivatives Trading: Saudi Arabia’s Tadawul stock exchange initiated trading in single stock options on Monday, its latest product in the derivatives market. Customers will be able to trade options with underlying assets in some of the kingdom’s biggest companies, including Saudi Telecom, SABIC, Al-Rajhi Bank, and Saudi Aramco.

🛒 Egypt Expansion: Dubai-based Majid Al Futtaim plans to invest $1 billion in a variety of projects in Egypt and double the number of Carrefour supermarkets it owns there to 70.

🛫 Taking Off: U.S. companies chalked up $128 billion in deals during last week’s Dubai Airshow, according to U.S. Ambassador to the UAE Martina Strong.

Power Circuit

Emir of Kuwait Sheikh Nawaf Al Ahmad Al Sabah was hospitalized on Wednesday “due to an emergency health problem,” the state-run KUNA news agency reported. The 86-year-old ruler was later described to be in stable condition.

Pope Francis canceled his planned trip to Dubai for the COP28 climate summit because of lingering effects from flu and lung inflammation, the Vatican said.

UAE President Sheikh Mohammed bin Zayed Al Nahyan met at Expo City on Wednesday with Cuban President Miguel Diaz-Canel, who is visiting Dubai for COP28.

Saudi Arabia’s Crown Prince Mohammed bin Salmanmet with Brazilian President of Luiz Inacio Lula da Silva at Al-Yamamah Palace in Riyadh on Tuesday.

Sheikh Khaled bin Mohamed Al Nahyan, Crown Prince of Abu Dhabi and Chairman of the Abu Dhabi Executive Council, attended the launch of AI171, a new artificial intelligence company developed by Abu Dhabi’s Advanced Technology Research Council.

On the Circuit

Courtney Powell, COO of 500 Startups, said she moved to Riyadh in 2021 because it was “very clear” to the California-based venture capital fund that “the Middle East was going to be a powerhouse globally.” Speaking on a panel of venture capitalists at the Fortune Global Forum in Abu Dhabi on Wednesday, she talked about waiting for the pipeline of targets to grow, noting the number of investable startups is still lacking compared to the West.

Jonathan Medved, CEO of the Jerusalem-based VC platform OurCrowd, declared artificial intelligence “underhyped,” adding that Israel’s most active venture capital fund has 81 investments in the technology. Commenting on his investment approach to AI at the Fortune Global Forum in Abu Dhabi, Medved said: “I want to be in picks and shovels; I want to be a Levi Strauss. I want to sell the jeans to the people hunting the gold.”

Ibrahim Ajami, Head of Ventures at Mubadala Capital, remarked that sovereign wealth funds, particularly as technology investors, have historically been viewed as allocators, but remarked at the Fortune Global Forum in Abu Dhabi on a “shift to being shapers of technology. That shift has never been more real and powerful than it is today in the Gulf.”

Jeff Shell, Former Chief Executive of NBCUniversal, is in advanced talks to join private equity firm RedBird Capital Partners, leading its sports and entertainment investment business, the Wall Street Journal reports. Jeff Zucker, also a past CEO of NBCU, heads RedBird IMI, a partnership between the firm and International Media Investments, an Abu Dhabi-based media holding company.

Omar Abou Ezzeddine was appointed Regional Managing Director for the Middle East and Africa at Media.Monks, the digital operating brand of S4 Capital.

Changpeng Zhao, the former CEO of Binance who pleaded guilty to violating anti-money laundering rules, was temporarily barred by a Seattle federal judge from returning home to the UAE, pending a final decision, while he awaits sentencing in February.

Jon Rahm, the defending Masters champion and No. 3 PGA player, is reportedly weighing a $600 million offer to switch to the Saudi-backed LIV Golf tournament.

Alan Howard, the billionaire co-founder of Brevan Howard Asset Management, said Abu Dhabi has the potential to become a global financial center, telling a panel at the Abu Dhabi Finance Week conference that the city’s strong regulatory regime, favorable taxation and Europe-aligned time zone make it attractive to financial firms.

Culture Circuit

💃 Eco-Fashion: COP28 will present the climate summit’s first-ever fashion show on Dec. 6, showcasing designers who create clothing that aligns with its goals of promoting environmental sustainability.

📽️ Movie Stars: Saudi Arabia’s Red Sea International Film Festival, which starts this Thursday in Jeddah, will present honors to German actress Diane Kruger, who starred as Helen in the 2004 movie “Troy;” Bollywood director Ranveer Singh and Saudi actor-writer Abdullah Al-Sadhan. The 10-day festival will open with the film “HWJN,” made by Dubai-based Iraqi director Yasir Al-Yasiri.

🏀 NBA Sale: Dallas Mavericks owner Mark Cuban is reportedly selling a significant stake in his NBA team to Dr. Miriam Adelson, The Steinline reports. The Mavericks played two exhibition games in Abu Dhabi against the Minnesota Timberwolves in early October, which Adelson and her family attended.

📺 Arabian Sharks: Hit American business show “Shark Tank,” in which budding entrepreneurs present ideas to a panel of investors, is being adapted by Dubai TV for broadcast in Arabic.

Ahead on the Circuit

Nov. 27-30, Abu Dhabi, UAE: Abu Dhabi Finance Week. Annual gathering bringing leaders in government and business from 100 countries. Various locations in Abu Dhabi.

Nov. 30-Dec. 12, Dubai, UAE: COP28 U.N. climate conference. Global gathering opens with speech by King Charles III, drawing government leaders, environmental groups and energy companies. Expo City.

Dec. 4-7, Ras Al Khaimah, UAE: 6th International Conference on Global Warming: The Critical Role of Oceans. A parallel conference to COP28 bringing together experts to find solutions to mitigate the effects of climate change with a focus on ocean ecosystems. Movenpick Resort.

Dec. 5 & 7, Dubai, UAE: Atlantic Council Global Energy Forum. Industry leaders, investors, policymakers gather at annual conference to discuss the future of energy use and new forms of power generation. COP28 Green Zone Connect Conference Center (Dec. 5), St. Regis Dubai, The Palm (Dec. 7).

Dec. 7-8, Abu Dhabi, UAE: Milken Institute Middle East and Africa Summit. The fifth annual gathering of business leaders, investors, government officials and philanthropists on the theme “Navigating Complexity through Collaboration.” Location to be confirmed.