The Weekly Circuit

👋 Hello from the Middle East!

This week, we’re looking at the risks and rising costs of Red Sea shipping, a final reckoning of 2023 VC funding in MENA, the UAE’s moon mission agreement with NASA and Iran’s suspension of flights to Saudi Arabia. But first a glance at MBZ’s trip across the Gulf to visit the world’s most populous country.

All eyes are on India, one of the UAE’s most critical economic partners, as President Sheikh Mohamed bin Zayed touched down to attend the three-day Gujarat Global Summit that started on Wednesday. He was received at the airport by India’s Prime Minister Narendra Modi, the two leaders meeting for the fourth time in less than seven months – this time in Ahmedabad, one of the country’s largest cities.

The two nations announced agreements to develop renewable energy, food processing and healthcare. UAE port operator DP World and the government of Gujarat province also signed a preliminary agreement to build green ports.

The UAE-India relationship cannot be understated, with 3.5 million Indian expats living in the Emirates as of 2021, making up over a third of the country’s population. The UAE is India’s third-largest trading partner. In 2022, an economic partnership agreement was forged that helped boost bilateral trade to $38.6 billion in the first nine months of the year – almost double the figure recorded in the same period in 2020. During Modi’s visit to the UAE in July last year, the two nations signed an agreement to settle trade in the Indian rupees, instead of U.S. dollars.

Modi will travel to Abu Dhabi next month to inaugurate the Middle East’s first traditional Hindu stone temple, the BAPS Hindu Mandir, and attend a community reception of Indian expats planned at Zayed Sports City Stadium in the capital on Feb. 13.

Due to disruptions in the Red Sea, shipping costs soared by nearly 250% during the two months in which Yemen’s Houthi rebels have been attacking commercial vessels in the Red Sea. Charges for transporting a 40-foot container from China to Europe through the waterway have risen to about $4,000, up from $1,148 on Nov. 21 when the attacks began, according to the Drewry World Container Index, which tracks container freight rates.

Egypt and Abu Dhabi, however, are banking on the Red Sea’s future. AD Ports got approval from Egypt to connect the UAE capital to Red Sea ports in Upper Egypt under a new contract to build, operate and maintain terminals for cruise lines. Abu Dhabi’s Zayed Port will link to Safaga, Hurghada and Sharm El-Sheikh and eventually plug into a broader network of Arabian Gulf hubs, Aqaba and Europe and Asia, according to the Egyptian Ministry of Transport. The ADQ-backed AD Ports aims to have its first Egypt terminal operational by 2025.

The Abu Dhabi cryptocurrency mining and blockchain company Phoenix Group is investing $187 million in Bitcoin mining machines following a lucrative IPO on ADX last month. The company’s wholly owned subsidiary, Phoenix Computer Equipment Trading, has agreed through a related party Cypher Capital DMCC to purchase Bitcoin mining machines from industry giant Bitmain Development. International Holding Co., Abu Dhabi’s largest conglomerate chaired by Sheikh Tahnoon bin Zayed, bought a 10% stake in Phoenix in October of last year. Phoenix is also developing a crypto-mining farm in Oman, The Circuit previously reported.

Saudi Arabia’s Tadawul stock exchange is launching a new index to track its top 50 companies, which account for 90% of the Riyadh-based bourse’s value. The new TASI 50 index, which will be used as a benchmark for exchange-traded funds, futures and options, is part of the kingdom’s efforts to attract foreign investors and diversify its economy beyond oil.

The UAE signed an agreement to participate in NASA’s Lunar Gateway project to build a new space station in cooperation with the U.S., Canada, Japan and the EU. The UAE’s Mohammed bin Rashid Space Centre agreed to supply the tailor-made airlock for entering and exiting the space station, which is expected to be launched by 2030. The agreement enables the UAE to send its own astronauts to the space station, which will be used as a transfer point in NASA’s Artemis project to establish a sustainable human presence on the moon.

Welcome to The Weekly Circuit. Read on for the stories, deals and players at the top of the news across the MENA business landscape. Please send comments and story tips to [email protected].

GLASS HALF FULL

Gulf venture financing held steady in 2023 amid funding drought in U.S., Europe, Israel

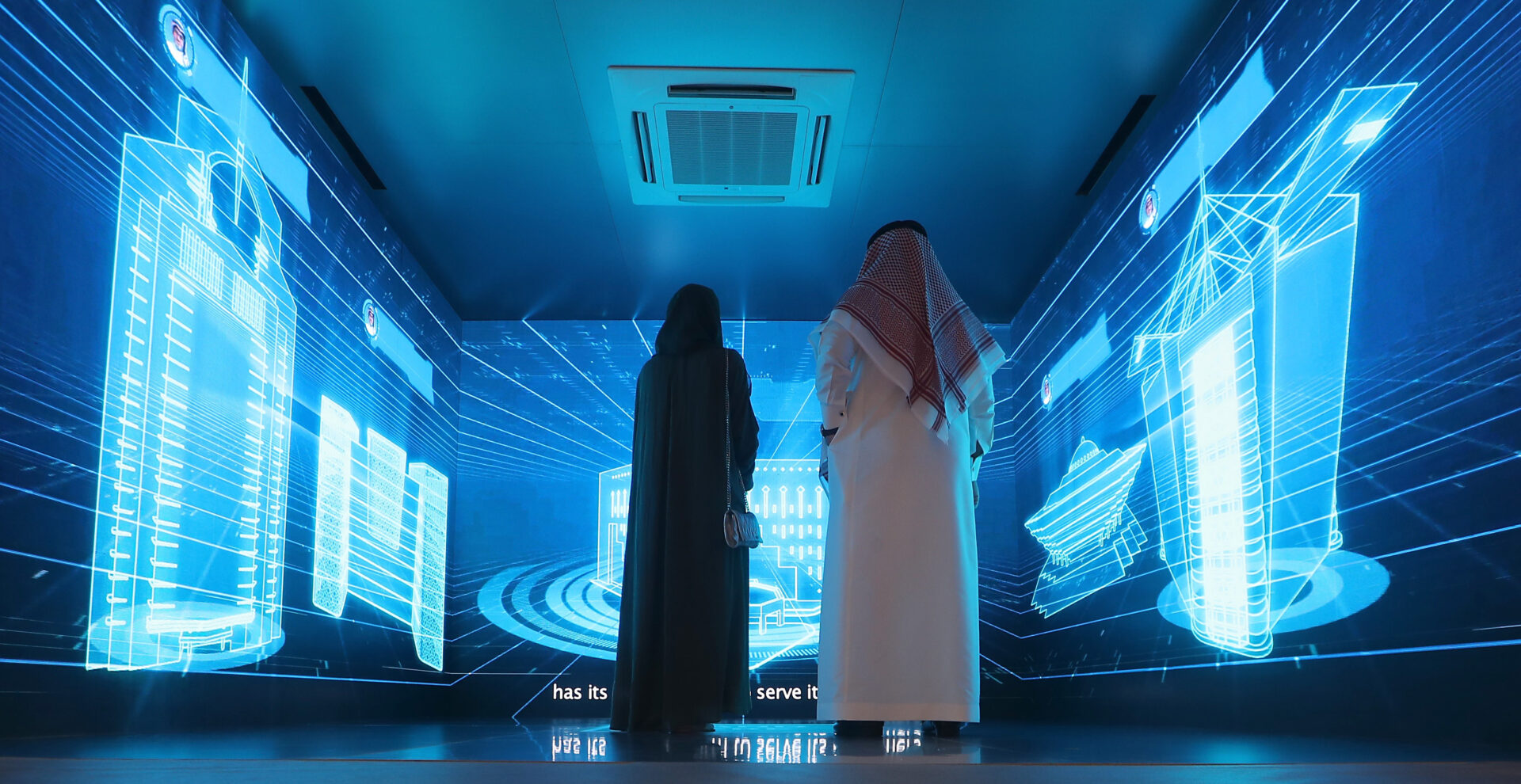

Saudi nationals attend GITEX at the Dubai World Trade Center in Dubai. (Photo by KARIM SAHIB/AFP via Getty Images)

Saudi Arabia has come out on top in a final reckoning of venture capital activity in 2023, as the kingdom continues to lure startups from innovative competitors in the Middle East and Africa, The Circuit’s Kelsey Warner reports.

Debt expectations: Including debt financing deals, which propped up much of the deal activity last year, investment in Saudi Arabia-based startups grew 160%, while debt-free investment rose 48% compared to 2022, according to a new report from UAE startup platform Wamda. “Debt financing typically rises when investors become hesitant and, given what is happening both globally and regionally, I expect it to grow this year too,” Triska Hamid, editorial director at Wamda, told The Circuit.

Bucking a trend: Gulf investors poured a steady flow of cash last year into tech companies, bucking the global pullback from startup funding in the midst of economic slowdown and regional conflicts. Financing from the MENA region rose 1% to about $4 billion in 2023. By contrast, seed funds for startups plunged 60% in Israel, 44% across Europe and 30% in the U.S..

Steep drop: Look at how capital was raised in MENA more broadly and it’s a less rosy picture: nearly half of total fundraising came through debt financing in 2023. Equity accounted for $2.2 billion across 488 deals, down 36% from the $3.45 billion raised in 2022 and a steep decline from the nearly 800 deals done last year, according to Wamda.

Sovereign Circuit

Public Investment Fund: Saudi Arabia’s sovereign wealth fund raised its stake to 23% in Middle East Paper Co. (MEPCO), one of the region’s largest makers of cardboard and paper products. PIF was also among the investors listed as holders of risky property participation rights issued by Austria’s Signa Prime Selection, which is now undergoing insolvency proceedings, Bloombergreports. The PIF-backed NEOM mega-project signed a preliminary agreementwith the Saudi Ministry of Energy to advance cooperation, state news media reported on Sunday. Hong Kong’s Tsangs Group, which struck an agreementlast month with the PIF-owned ROSHN Group to facilitate technology investments, hopes to help create more “bilateral investment pipelines” between Chinese family offices and Saudi enterprises, Chairman Patrick Tsang told Asian Investor.

ADQ: The Abu Dhabi-based fund is mulling a bid in the competition to buy a minority stake in ICD Brookfield Place, Dubai’s largest office tower, a building worth as much as $1.5 billion, Bloomberg reports.

Mubadala: Brazil’s state-owned oil company Petrobras and Mubadala Capital are reportedly looking to formalize a partnership agreement after discussions earlier this year to co-develop biofuels in Brazil. The Emirati fund’s Mamoura Diversified Global Holding company held a bell-ringing ceremony at the Abu Dhabi Securities Exchange on Tuesday to announce the listing of $4.5 billion of dollar-denominated bonds and AED 750 million of dirham-denominated bonds.

Sovereign Fund of Egypt: The SFE plans to finance the development of downtown Cairo with the building of hotels that hold 2,600 rooms, refurbishing of historic buildings and creating 15,000 square meters of parks and green spaces.

Circuit Chatter

🏭 Mineral Energy: Saudi Arabia plans to build an industrial accelerator park aimed at sparking innovation in generating low-carbon energy from minerals, Minister of Industry Bandar Alkhorayef told the Future Minerals Forum in Riyadh.

🚢 Risky Business: COSCO Group, China’s largest cargo-shipping company, has notified customers that it is suspending service to Israel because of danger to its vessels in the Red Sea, Calcalist reports.

📺 TV Sequel: Former CNN President Jeff Zucker talks to The New York Times about investing in the independent Hollywood studio Media Res through his Redbird IMI joint venture with Sheikh Mansour bin Zayed al Nahyan, Vice President and Deputy Prime Minister of the UAE.

🏢Trump Probe: Hotels and residential properties belonging to Donald Trump received $7.8 million during his presidency from foreign governments, topped by China and Saudi Arabia, a report by House Democrats said. Trump has maintained there was nothing illegal about his companies doing business with overseas customers.

🌏Chinese Puzzle: The Economist examines China’s growing connections in the Gulf and asks, “Can Sino-Arabian business ties replace Sino-American ones?”

Closing Circuit

🇦🇪 Positive Performance: The UAE’s non-oil economy reported its second-best month in nearly five years, according to the December index-tracker from S&P.

💰Tech Fund: Israel’s Liquidity Group is raising $200 million for its sixth debt fund, which will focus on technology ventures, Calcalist reports. The Harel Insurance Group, which will invest $30 million in the new fund, will be the anchor investor.

🔒 Unicorn Defense: Aqua Security, an Israeli startup that protects cloud networks, raised $60 million in a funding round that valued the company at more than $1 billion.

🚗 Car Crash: Shares of Mobileye fell 28% in New York trading on Jan. 4 after the Jerusalem-based maker of self-driving vehicle equipment warned that lower-than-expected sales substantially hurt its 2023 earnings.

☀️ Solar Power: BlackRock, the world’s largest alternative assets manager, increased its stake to 15.8% from 9% in Israel’s SolarEdge, which makes equipment for optimizing solar panels.

🚙 Swift Commute: Dubai’s Road and Transport Authority awarded a $90 million contract to improve a traffic artery through its Umm Suqeim residential neighborhoods.

🌾 Growth Stage: Maalexi, a UAE-based risk management platform for farming businesses, raised $3 million in seed funding, led by Global Ventures.

⛽ Energy Exploration: Oman signed an agreement giving rights to Lebanon’s CC Energy Development to explore for oil and gas in the southern Dhofar region.

Power Circuit

U.S. Secretary of State Anthony Blinken traveled to Egypt on Wednesdayfor consultations on the Gaza war with Egyptian President Abdel Fattah El-Sisi to conclude a Mideast tour that has taken him to Israel, Jordan, Saudi Arabia, the UAE, Qatar and Turkey.

Jordan’s King Abdullah II hosted a meeting in the Red Sea port city of Aqaba on Wednesday with President El-Sisi and Palestinian Authority President Mahmoud Abbas to discuss the Gaza war.

Saudi Crown Prince Mohammed bin Salman hosted U.S. senatorsincluding Virginia Sen. Mark Warner, chairman of the Senate Intelligence Committee, Texas Sen. John Cornyn, New York Sen. Kirsten Gillibrand, Georgia Sen. Jon Ossoff, and Arizona Sen. Mark Kelly at his winter camp in AlUla. South Carolina Sen. Lindsey Grahammet with the Crown Prince on Sunday.

Kuwait’s Sheikh Mohammed Sabah Al-Salem, a Harvard-trained economist, was appointed prime minister by the emir, Sheikh Mishal Al Ahmad Al-Sabah.

UAE Prime Minister and Dubai Ruler Sheikh Mohammed bin Rashid rolled out a $56 billion program to double the number of Emirati families living in Dubai over the coming decade through investments in education and healthcare.

On the Circuit

Bill Anthony O’Regan was appointed CEO of Q Holdings, a subsidiary of International Holding Co., succeeding Majed Fuad Mohammad Odeh, who stepped down.

Tim Clark, president of Emirates airlines, said in an interview with Bloomberg that the mid-flight accident that blew a door off an Alaska Airlines Boeing 737 Max aircraft was a setback for the manufacturer and “just another manifestation” of its longtime problems.

Qing Pan, chief financial officer of Chinese wealth manager Noah Holdings, said the firm is expecting to get a business license in Dubai by the end of this year, as more Asian wealth managers look to do business in the Gulf.

India Commerce and Textiles Minister Piyush Goyal said the country will open a goods showroom and warehouses for Indian goods in the UAE dubbed “Bharat Park” as the countries boost bilateral trade.

Rashit Makhat, director and co-founder of Dubai venture capital firm Scalo Technologies, writes about projects underway in the Gulf leveraging AI to address water scarcity in an op-ed for The National.

Culture Circuit

🏎️ Start Your Engines: The 46th annual Dakar Rally took off from Saudi Arabia’s historic desert city of AlUla, featuring 434 vehicles and covering a distance of 4,850 miles. The legendary two-week race takes drivers through stretches of challenging terrain across the kingdom and ends on Jan. 19 in the Red Sea port of Yanbu.

🎙 Sailing Music: The Mubadala Abu Dhabi Sail Grand Prix, which takes place Jan. 13-14, announced it will host an opening day concert by British pop group Take That.

⛳ Teeing Off: The first Dubai Invitational golf tournament starts on Thursday at the Dubai Golf & Yacht Club, featuring Northern Ireland’s Rory McIlroy, the world’s No. 2 player. The biannual event is new on the DP World Tour, pairing 60 professional golfers with 60 amateurs for three of the four rounds. The final round on Jan. 14 is just for the pros, with the winner taking a $425,000 prize. Coming up Jan. 21 is the Dubai Desert Classic, which takes place at the Emirates Golf Club, followed by the Bahrain Championship on Feb. 4 and the Qatar Masters on Feb. 11.

🎾 Net Play: British tennis champ Emma Raducanu will compete in the Mubadala Abu Dhabi Open next month, organizers said. Raducanu, who won the U.S. Open title in 2021 joins Tunisia’s Ons Jabeur and Brazil’s Beatriz Haddad Maia as top draws in the WTA event, which Switzerland’s Belinda Bencic won last year. The tournament takes place Feb. 3-11 at the International Tennis Centre in Abu Dhabi’s Zayed Sports City.

Ahead on the Circuit

Jan. 9-12, Las Vegas, Nev.: Consumer Electronics Show. CES 2024 will showcase the latest advancements and products in technology, transportation and healthcare, with a focus on artificial intelligence. Las Vegas Convention Center, the Venetian Expo and the Aria Resort & Casino.

Jan. 13-14, Abu Dhabi, UAE: Mubadala SailGP. F50 racing boats go head-to-head at the Mubadala Abu Dhabi Sail Grand Prix, presented by the Abu Dhabi Sports Council. Mina Zayed Port.

Jan. 15-19, Davos-Klosters, Switzerland: World Economic Forum Annual Meeting. The annual meeting aims to drive public-private cooperation and this year will focus on exploring opportunities enabled by new technologies.

Jan. 16-18, Dubai, UAE, Intersec: Security conference bringing together government and vendors focused on domestic, cyber, commercial, fire and rescue. Dubai World Trade Center and Commercial Security, Safety & Health, and Fire & Rescue. Dubai World Trade Centre.

Jan. 22-24, Riyadh, Saudi Arabia: Real Estate Future Forum. A gathering of government officials, developers and investors exploring development opportunities in the kingdom. Four Seasons Hotel.

Jan. 22-25, Abu Dhabi, UAE: UMEX. The only conference in the Middle East dedicated to drones, robotics and autonomous systems. Abu Dhabi National Exhibitions Center.

Jan. 24, Kuwait City, Kuwait: Kuwait Innovation Forum. Startup founders, investors, policymakers meet for the annual conference. Arraya Ballroom.

Jan. 25, Dubai, UAE: Casino Countdown. First Middle East conference to focus solely on the gaming industry, sponsored by Arabian Business. Atlantis The Royal Hotel.

Jan. 25-27, Manama, Bahrain: Health/Wellness Expo 2024. Annual gathering of medical professionals and alternative treatment specialists. Exhibition World Bahrain.

Jan. 29-Feb. 1, Dubai, UAE: Arab Health. The biggest trade show in the region for medical devices and healthcare. Dubai World Trade Center.

Feb. 26-29, Doha, Qatar: Web Summit Qatar. A Middle East edition of the technology crowd mega-event, gathering investors, entrepreneurs and business leaders. Doha Exhibition and Convention Center.