The four companies will each take a 10% interest in the UAE energy company’s Ruwais LNG plant, which plans to start production in 2028

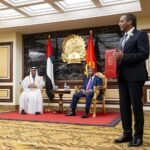

UAE President Sheikh Mohamed bin Zayed welcomes the heads of global energy companies visiting Abu Dhabi to sign agreements backing ADNOC’s Ruwais LNG project. (Photo: WAM)

Chief executives from three of Europe’s largest energy companies and a top Japanese conglomerate came to Abu Dhabi this week to sign agreements backing state-owned ADNOC’s ramped-up efforts to sell liquified natural gas.

Each of the firms – Shell, BP, TotalEnergies and Mitsui & Co. – will take a 10% interest in ADNOC’s Ruwais LNG plant, a project scheduled to begin production in 2028 as spending on gas as a cleaner alternative fossil fuel to oil is projected to rise. Payments were not disclosed.

Signing the contracts to take part in the LNG venture on Wednesday were Murray Auchincloss, CEO of BP; Wael Sawan, CEO of Shell; Patrick Pouyanné, Chairman and CEO of TotalEnergies; and Kenichi Hori, President and CEO of Mitsui, according to a UAE government statement.

The executives were hosted by UAE President Sheikh Mohamed bin Zayed in a sit-down at the beachside Qasr Al Shati palace. Dr. Sultan Al Jaber, ADNOC Managing Director and Group CEO, signed the agreements with the other executives during a separate meeting with Sheikh Khaled bin Mohamed bin Zayed, Crown Prince of Abu Dhabi and Chairman of the Abu Dhabi Executive Council.

“As natural gas demand continues to increase, this world-class project will enable us to provide more lower-carbon gas to meet growing demand today while helping the world transition to a cleaner energy future,” said Dr. Al Jaber, who continues to serve as President of COP 28, the United Nations climate conference that was held in Dubai last December.