As Saudi Arabia broadens its economy beyond dependence on oil, the kingdom has sought to create a business environment that acts as a magnet for international investment.

Central to the mission is state-owned real estate developer ROSHN, which has started to seed greater metropolitan Riyadh and other urban areas with upscale residential communities aimed at both Saudi and expat professionals.

The emerging neighborhoods cater to families by incorporating schools, parks, mosques, supermarkets and retail shops into the developments amid tens of thousands of homes.

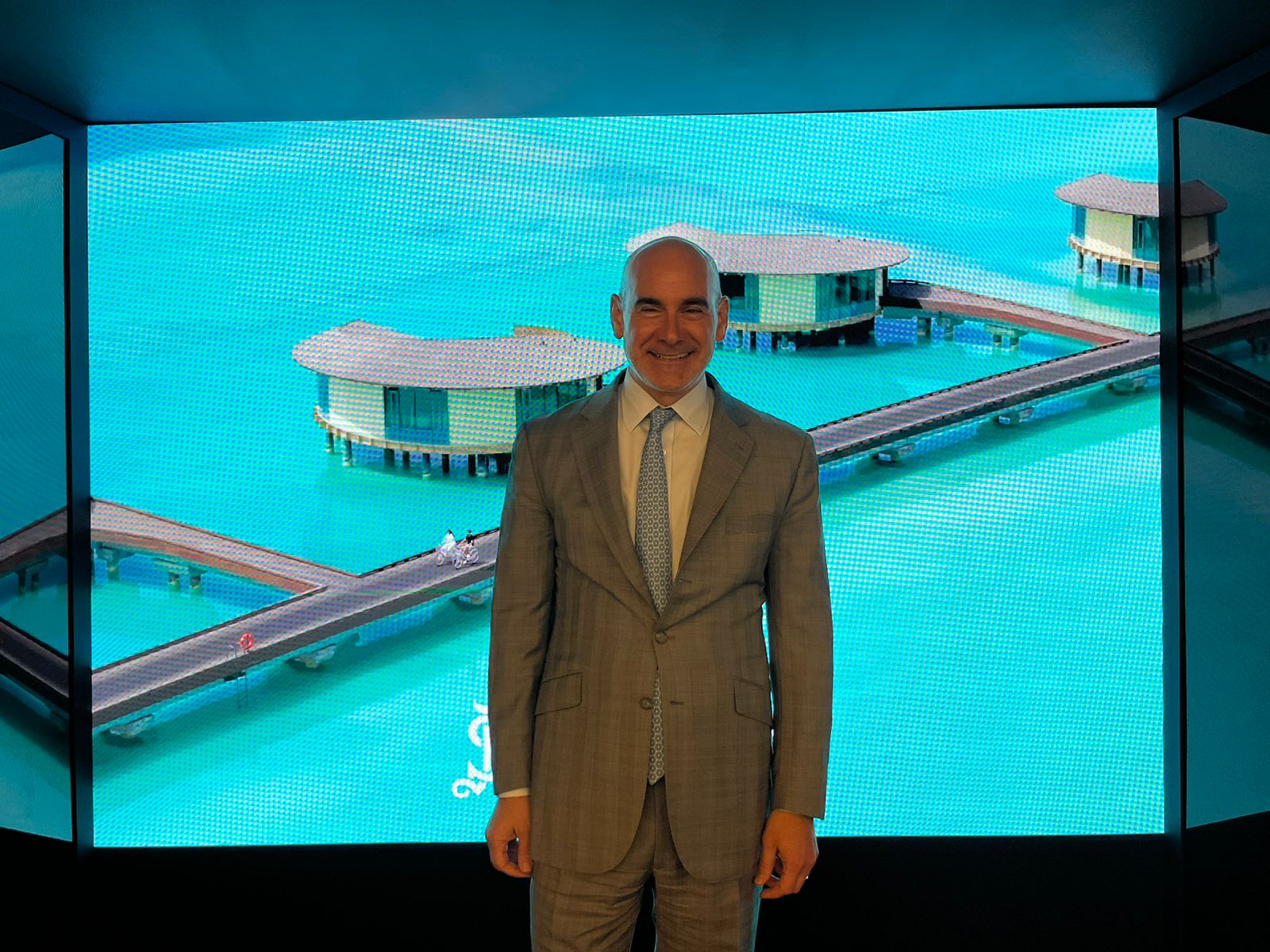

In an interview with The Circuit, ROSHN’s Waleed Bawaked, Senior Director of Strategy and Planning, and Roger Fatovic, Executive Director of Program Management, outline the company’s blueprint for growth – first across Saudi Arabia and ultimately through expansion abroad.

ROSHN was established in 2020 by the Saudi Public Investment Fund and has raised $4.3 billion in the past two years. Its flagship project, Sedra, will contain 30,000 residential units on a plot of land measuring 20 million square meters and located near Riyadh’s King Khaled International Airport.

The company has also announced projects in Jeddah, Mecca and Dammam.

Are you expecting a boom in the Saudi real estate industry?

Waleed Bawaked: We are already seeing this, particularly in Riyadh, where demand and prices are rising. We are striving to support the market, and with the country’s broader aims, real estate will continue booming and contribute to sustained profitability.

Roger Fatovic: Saudi Arabia is a significant market with around 30 million people, including expatriates. With 22 to 23 million Saudis, it’s the largest market in the GCC and has the fastest-growing population. It is flowing.

What is your strategy for reaching your goals?

Bawaked: Our mandate is to redefine and reshape the real estate sector in the country. We are mainly contributing to one of the key visions, focusing on quality of life, and this is our way of doing it. So, ROSHN was created to support the development of integrated communities, redefining what the locals and residents of Saudi Arabia should expect in a residence. We aim to provide communities supported by diverse assets within walking distance, incorporating the latest technology and ensuring sustainability from an environmental standpoint.

How do you determine which projects are worth moving forward with for implementation?

Fatovic: Our core business, one of the key focuses, is large residential and master-planned communities – complete turnkey solutions. So we don’t just build 100 villas here and 100 villas there. We do the villas, schools, mosques, parks, and all the supporting developments. This includes commercial spaces, retail, leisure, and hospitality. Our entry point is around 2,500 to 3,000 units ; we find that’s the number we need to achieve critical mass for schools, retail, and healthcare.

What factors guide your decision to prioritize a specific area for project development and implementation?

Bawaked: We’ve been mandated to focus on select regions and cities, mainly because these areas encompass over 80% of the population and are key economic anchors. We recognize a strong demand with a shortage of good-quality supply, which serves as our entry point. Within these cities, we leverage data analytics to understand urban growth trends, target market segments, and tailor our projects accordingly. As a profit-driven company, we aim to meet the needs of specific market segments. For example, in areas with higher income levels, our product offerings vary accordingly. Throughout the process, we ensure engagement from both the private and public sectors to shape the area’s future, accounting for other upcoming projects, connectivity, and customer preferences. This approach helps us design and build with a clear understanding of what will elevate our target segment’s experience.

How is the market shaping up for luxury real estate in Saudi Arabia? Are we seeing increased demand, and is it driven more by local or international interest?

Bawaked: I think it’s a bit of both, stemming from significant investment in Saudi, whether in projects or human capital. We see many Saudis in higher positions with substantial incomes seeking premium products locally. Externally, various government-led initiatives, as well as efforts by the Ministry of Investment and PIF, are attracting foreign direct investment and talent, which creates demand for premium and luxury offerings.

Is there a particular project you’ve implemented in Saudi Arabia that you’re interested in replicating?

Fatovic: We are doing that all over Saudi Arabia at the moment. A prime example is Sedra, our first and landmark project. ROSHN was the first PIF entity to generate revenue, sell to end-users, and hand over properties to end-users. Sedra, located near the airport, will see around 4,000 units handed over to end-users by the end of this year. For us, it’s about continuous improvement. We’ve learned from Sedra one, applied those lessons to Sedra two, Al Rus in Jeddah, and the Dammam project. It’s always about learning what works in the market and building on it for our future projects.

Have you considered expanding your efforts beyond Saudi Arabia?

Bawaked: At the moment, our focus is mainly on Saudi Arabia. We envision ROSHN as a leading real estate developer, not only locally but on a global scale. Right now, however, we have enough to deliver within the local market.

How do you assess whether a project has the potential to be profitable?

Bawaked: We work closely with external advisors and consultants to help us understand the market in terms of supply and demand, and we conduct feasibility and financial studies to meet specific ROI thresholds. Of course, we’re aware that market dynamics can change, so we proceed cautiously, adjusting our approach as needed to align with market perceptions and enhance our projects accordingly.

Fatovic: We maintain a continuous feedback loop, especially in the early stages of a project, involving Waleed’s team, development, and delivery. Once land is identified, we determine its highest and best use. We use many external consultants, but after five years, I don’t think there’s a consultant with a better cost database for residential development than we have. It’s a constant feedback loop involving strategy, development, construction, cost validation, and revenue assessment to decide the optimal product.

Add The Circuit on Google

Add The Circuit on Google