Trump forged a close relationship with the Saudi Crown Prince during his first term, lauding his purchase of some $500 billion in U.S. weapons

U.S. President Donald Trump and Saudi Arabia's Crown Prince Mohammed Bin Salman speak at the G20 Osaka Summit in 2019 (Getty Images)

Saudi Arabia’s Crown Prince Mohammed Bin Salman and U.S. President Donald Trump are picking up where they left off four years ago.

After congratulating Trump on his return to Washington in a phone call on Wednesday, Prince Mohammed, who is also Prime Minister, said he’s willing to boost investment and trade with the U.S. by $600 billion through 2028.

The Saudi kingdom hopes to participate in the new U.S. administration’s “ability to create unprecedented economic prosperity and opportunity,” the Crown Prince said in the SPA dispatch.

Trump responded on Thursday during a virtual address to the World Economic Forum in Davos.

“I’ll be asking the Crown Prince, who’s a fantastic guy, to round it out to around $1 trillion,” Trump said, adding, “I think they’ll do that because we’ve been very good to them.”

Trump, appearing on screen from the White House during his 15-minute speech, took questions afterward from a panel in Davos that included Blackstone CEO Stephen Schwarzman, Bank of America CEO Brian Moynihan, TotalEnergies CEO Patrick Pouyanne and Banco Santander Chair Ana Botin.

Trump forged a close relationship with the heir to the Saudi throne during his first term and said he selected the kingdom for his first overseas trip as president in 2017 because of its commitment to buy U.S. weapons and other goods.

Shortly after his inauguration on Monday, Trump told reporters he’d consider visiting Saudi Arabia again if it would agree to buy “another $450 billion or $500 billion” worth of U.S. products.

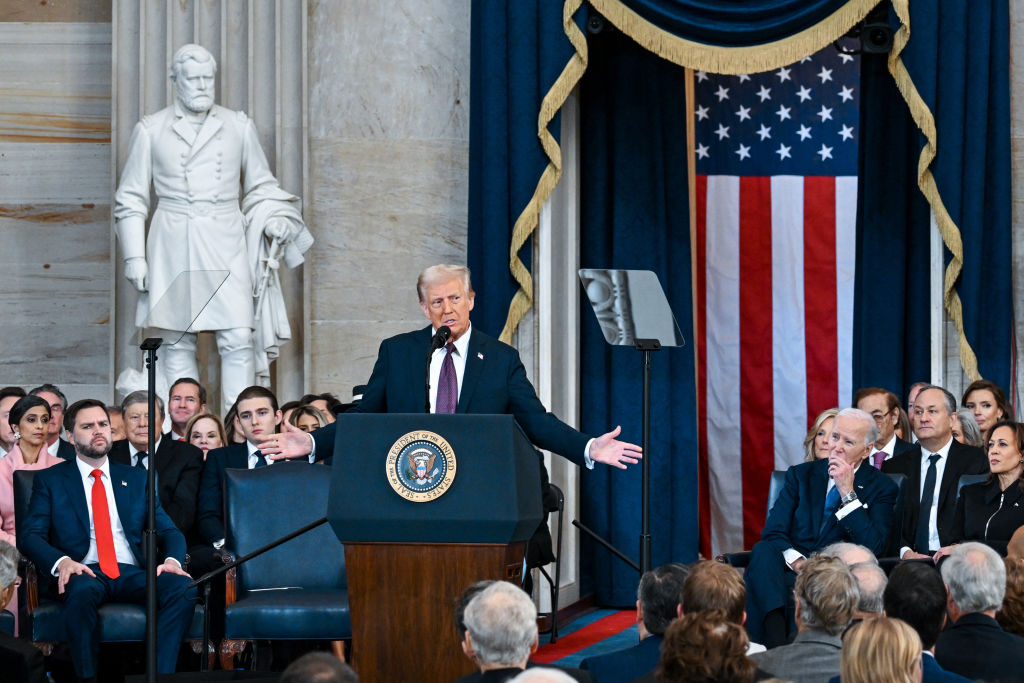

Even before he stood inside the Capitol this week to take the oath of office, Trump made clear that the Gulf’s power players will find a friend in the White House.

Damac Group CEO Hussain Sajwani for one. The billionaire Dubai builder turned up a week into the new year at Trump’s Mar-a-Lago resort in Palm Beach, Fla., where he stood beside the President-elect and pledged an investment of at least $20 billion to build new data centers across the U.S.

Sajwani, who has described himself in press releases as “Trump’s Middle Eastern business partner,” said Damac would move ahead with the plan “if the opportunity, the market, allows us.”

The relationship between the two men dates back a decade when Trump and Sajwani teamed up to develop luxury golf courses in Dubai. Trump said the massive investment in data centers will “keep America on the cutting edge of technology and artificial intelligence.”

A second Gulf financial chieftain who has been circulating around Trump since his election in November is Saudi Arabia’s Yasir Al-Rumayyan, governor of the Public Investment Fund.

Al-Rumayyan is also Chairman of LIV Golf, the upstart PIF-owned tournament that first challenged and now may merge with the PGA.

The new league, which poached some of the PGA’s top stars with contracts of as much as $200 million, announced Tuesday that it would hold a tournament in April at the Trump National Doral resort near Miami for the fourth consecutive year.

Add The Circuit on Google

Add The Circuit on Google